The resurgence of Bitcoin price ( BTCUSD at Coinbase) has been impressive, the pioneer cryptocurrency reclaimed $10k levels and surpassed $10,250 level again. July month rallies has showed almost close to 12.5% upswings (currently, trading at $10,266 levels while articulating).

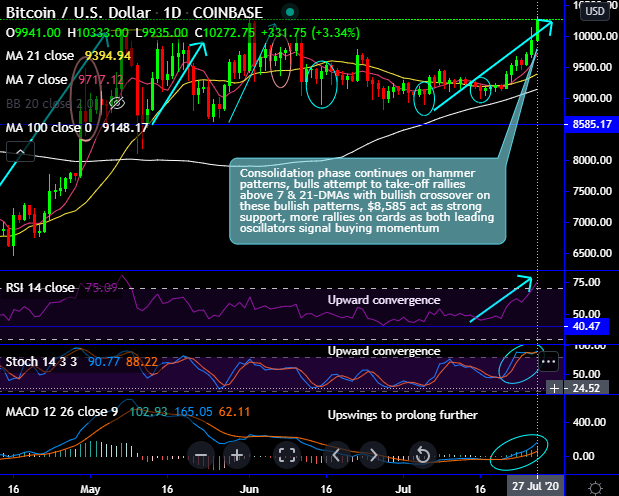

The consolidation phase continues on hammer formations at $9,074 and $9,130 levels, consequently, the bulls attempt to take-off rallies above 7 & 21-DMAs with bullish crossover on these bullish patterns, $8,585 act as strong support, more rallies are on the cards as both leading oscillators are still signalling the buying momentum.

Since mid-March, BTC has spiked from $3,858 to the recent highs of $10,079 which is 160% rallies but currently wedged in a range.

We are observing short-term traders are snapping rallies for momentary gains, this shouldn’t be seen as panic sell-offs.

On a broader perspective, we wouldn’t mind reiterating more upside risks are still on the cards in the days to come with the strong supports of $8,585 and $7,950 levels (i.e. 100-DMAs), hence, long hedges have already been advocated using CME BTC Futures when the underlying BTC spot was trading at $4,927 levels, and we wish to uphold the same positions by rolling over August months tenors. It is unwise to keep speculating on the next upside target and accumulate fresh bitcoins or go for fresh short build-ups at this juncture. Instead, one can certainly uphold the above advocated long hedges for now (spot reference: 10,266 levels).

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One