Bitcoin (BTCUSD at Coinbase) price has been stabilized and regained the buying sentiments amid the struggle of the financial markets due to pandemic outbreak. The price of bitcoin has now reclaimed $7,000 levels and stabilizing well these above.

So what’s driving such bullish rallies of the pioneer cryptocurrency is the interesting puzzle when entire financial and commodity markets are struggling and economies are sensing recessionary phases. The investors’ expedition is to target safe-haven under such circumstances. When bitcoin has been incepted and designed for the financial crisis times, quite a few analysts perceive the ongoing rallies are driven by the safe-haven sentiments.

Apart from that, fundamentally, it is quite crucial period in the run-up to Bitcoin block reward halving in May (scheduled around 18th May 2020) which is conducive for the underlying prices.

It is worth reiterating that having total reported death cases exceeds due to the deadly contagious coronavirus, almost all markets have halted with a trauma.

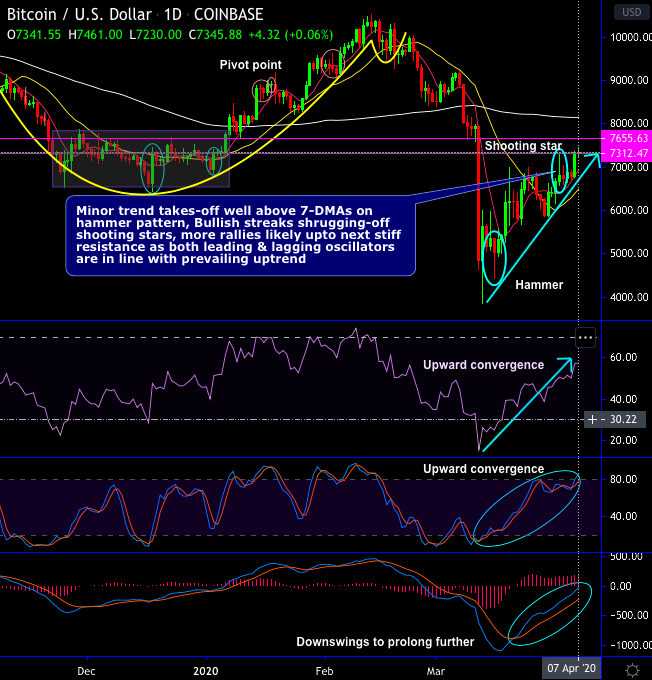

As the outbreak widens, technically, the minor trend of BTC takes-off well above 7-DMAs upon hammer pattern occurrence at $5,037.61 levels.

On the contrary, shooting star has popped up at $6,804.52 levels to signal the exhaustiveness in the bulls’ rallies.

Consequently, the bullish streaks have briefly taken a halt at the stiff resistance of $7,312 levels, For now, extension of rallies up to the next stiff resistance as stated before.

The prevailing bullish streaks are shrugging-off shooting star, more rallies likely up to the next stiff resistance of $7,655 levels as both the leading and lagging oscillators are in line with the prevailing uptrend.

Hence, the current price is trading at $7,345 levels while participating in prevailing buying sentiments.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential