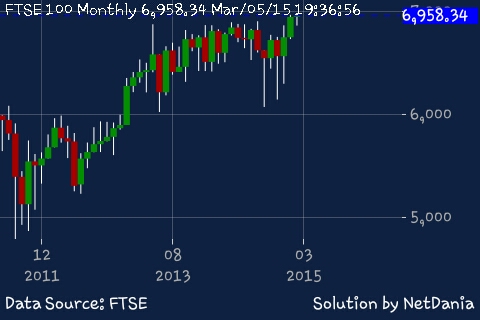

Since 2008 financial crisis DOW, S&P 500, DAX and several others have either broken above their previous all-time high or pre crisis high but FTSE 100 kept lagging them. Currently it is struggling to break above the level, moreover Bank of England kept insisting at rate hike to be the next probable move.

Still this may not be the time to give up on FTSE -

- a) Financial sector is robust - Financial Services in London is the strongest among the world despite large volume trading in US and ultra-liquid dollar. As per latest data from Bank of International Settlement nearly 50 percent of the interest rate derivatives and 40 percent of the currency trades passes through UK and the numbers are growing. Recently UK won the case over ECB regarding the Euro clearing and may not ever join the tough regulation regime.

- b) ECB QE - Like the asset purchase of FED moved money across globe and benefited equities as a whole, similar would happen with UK as well. Strong Euro zone economy would be good for UK too though weaker Euro against pound would hurt.

- c) UK is strong - GDP growth is at 2.7 percent. Manufacturing, Construction and service all expanding but a varied pace.

- d) Cheaper valuation - Pound is close to 25 percent weaker than pre crisis level that makes them much cheaper to hold.

We expect the FTSE to do well in the time ahead in spite of its current struggle for new all-time high. FTSE is currently trading at 6954 up from its immediate support near 6870. Breaking the 7000 level would provide momentum.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary