- US treasury yields are dropping across board, as speculators are increasing their bets over a slower pace of hikes in the US.

- Market has pushed back rate hike expectation from June to around September. FED participants kept the possibilities open for a hike at any of the three meetings, namely June, July and September.

- Recent rush of dollar and falling inflation has provided FED enough room to wiggle and tweak.

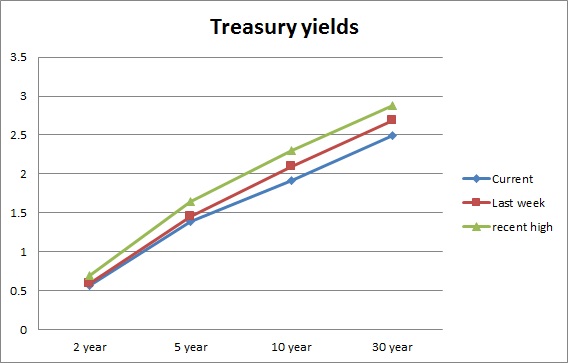

- However dovish comments and projections by FOMC participants are doing havoc in dollar and treasury markets. 2 year yield is trading around 0.56% compared to 0.68% before FOMC. Yield curve is explained in the chart.

- Latest dollar move higher, prior to FOMC was fueled partially by rising treasury yields. So lower treasury yields are not good news for dollar.

- For yield hungry pension funds, sovereign wealth fund it might still make sense to invest at a better yield than what's being offered across Europe, however they might choose to wait for the dust to settle down and FED's stance clears up.

Cross currency pairs are quite attractive namely the pound and kiwi based. Dollar index is currently trading at 97.3, down 0.5% today.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary