In recent past much has been said about a stronger US economy and recovering Euro zone from slump amid central banks' loose monetary policy. In spite of that, several global indicators continue to pose doubts on the recovery as a whole.

What is Baltic Dry Index?

- Baltic Dry index is a quote in USD published from London that is heavily used as a pricing indicator across globe by the shipping industry.

- It is an assessment of moving dry materials across sea. Similar index like Baltic Dirty index is used by oil tankers.

Why is it important?

- Global growth can't pick up alone without a pickup in industrial activity and transfers of goods across countries.

- It is a well-established index, giving cues on global growth and underlying price pressure.

Current levels -

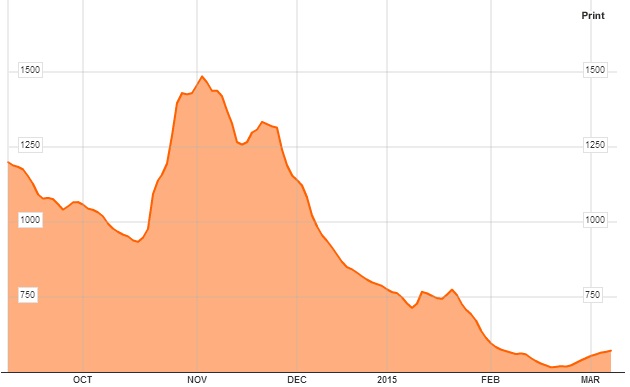

- Currently the index is trading at 565, below the levels of 1990s and down from its recent peak at 1500 in November last year.

- The index peak around 50,000 prior to 2008 financial crisis that prompted shipbuilders across world to increase the supply in the market. Rush has somewhat abated since then.

Indications -

- Supply is still at large compared to demand growth.

- Global growth is yet to recover ground and pace, in spite of strong US economy.

- China, which is a major consumer of raw materials across globe, might be slowing down much faster than anticipated.

- Bulk portion of the goods are raw materials, which still might not experience better days in foreseeable future.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings