Macro-economic data and announcements can be major market mover and can make millions for the one, whose bets are on the right side. A latest study by European Central Bank (ECB) indicate that group of traders could be unfairly benefiting from U.S. data, due to leakage.

If you have time and are interested in greater details, check out the working paper, “Price drift before U.S. macroeconomic news: private information about public announcements?” here, http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1901.en.pdf?ca0947cb7c6358aed9180ca2976160bf , if not, continue reading the summary.

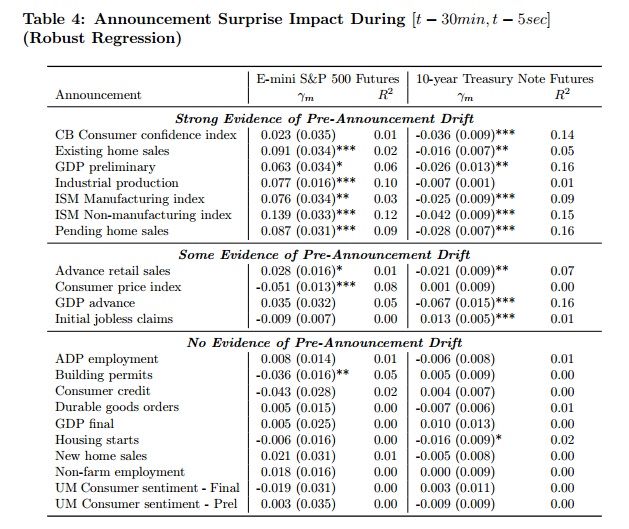

ECB researchers studied, 21 market moving U.S. indicators and third of them shows evidence of inside trading. Researchers studied price movement ahead of data release (known as price drift) and found prerelease price drift accounting for half of the price impact from the release. Researchers have worked on S&P 500 and 10 year treasury notes and it shows millions of Dollar can be made each year from S&P 500 alone.

These infamous sevens are - Conference Board’s consumer confidence index; the National Association of Realtors’ existing and pending home sales; the Bureau of Economic Analysis’ preliminary gross domestic product announcement; the Federal Reserve Board’s industrial production; and the Institute of Supply Management’s manufacturing index.

After the report, regulators and data providers are likely to tighten their grips over the releases but still without sophisticated gadgets and algorithms, retail traders can hardly profit from data trading.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed