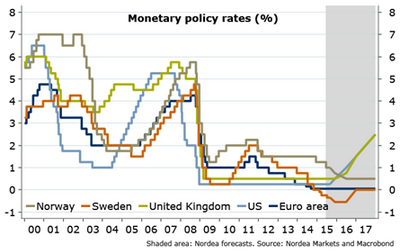

The ECB started to buy public sector bonds in March this year and intends to do so at least until September 2016. As it is seen, inflation by then will not be close enough to the 2% target and inflation expectations will not yet be "well anchored". Therefore, the ECB is expected to go on buying assets beyond September 2016.

"A half-year extension of the programme combined with an additional tapering period looks like a rather good first guess of how the purchase programme could evolve beyond September 2016. We expect the main refi rate to remain unchanged at 0.05% over the forecast horizon and the deposit rate to stay unchanged at -0.20%. For the next few months, the risk to our no-change baseline call is tilted towards more stimulus from the ECB", says Nordea Bank.

ECB to support recovery for long time

Wednesday, September 9, 2015 5:49 AM UTC

Editor's Picks

- Market Data

Most Popular

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says