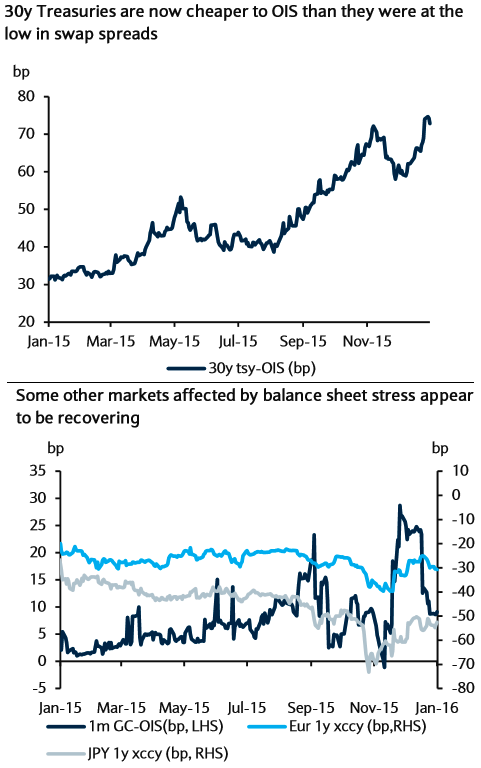

Balance sheet constraints do not appear to have significantly worsened over the past two months. Some measures of this, such as the spread between 1m repo rates and OIS or levels of cross-currency basis swaps in DM currencies, are at levels comparable to November (see diagram), after having worsened in December because of year-end concerns.

Further, while January is likely to have seasonally high issuance, future supply could be delayed by financial market uncertainty. Thus, issuance by itself is unlikely to explain the move in spreads.

On the other hand, the sell-off in EM currencies has worsened, potentially putting pressure on US Treasuries relative to swaps. Further, with rates now having declined since the beginning of the year and equity markets well off their peak, expectations of VA receiving may now be playing a role in keeping spreads tight.

As such, the fundamental picture of the US swap market has not changed: an excess of receivers who are relatively inelastic to the level of swap spreads, a lack of natural payers of swaps, and the marginal payers of swap spreads being leveraged entities that face balance sheet constraints.

We think that a considerable broadening in US spreads seems unlikely, predominantly at the long end, due to balance sheet constraints.

In vol, we recommend buying USD 3y*2y receivers struck at 1%, cheapened by selling 1y*(2y2y) receivers at the same strike, as a medium-term hedge against a downturn in the US. In the UK, we recommend buying 1y*5y 1x2 payer spreads as a way to position for a gradual sell-off in rates.

EM currency pressures and balance sheet concerns keep US swap spreads on edge

Wednesday, January 27, 2016 12:44 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX