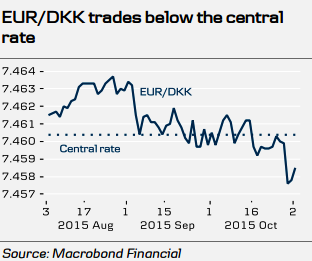

FX intervention was carried out by Danmarks Nationalbank to cap EUR/DKK upside, in the first half of October EUR/DKK traded above the central rate of 7.46038. DN has also published October's FX reserve and central bank balance sheet.

Should downward pressure on EUR/DKK return, DN might likely cap EUR/DKK downside around 7.4500 using FX intervention. The government's deposits at the central bank were DKK187bn in October, down from DKK194bn in September and above the budget projection.

This could perhaps be due to unexpected revenue from the extraordinary tax on capital pensions. While the government's deposits are ample at present, they are set to fall close to DKK100bn in November, when a large DGB redemption is due.

"There is currently no need for additional FX intervention purchase of DKK, with EUR/DKK currently trading below the central rate of 7.46038. EUR/DKK in 3M-12M is expected at at 7.4550", says Danske Bank.

EUR/DKK likely to trade at 7.4550 over coming months

Wednesday, November 4, 2015 4:07 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022