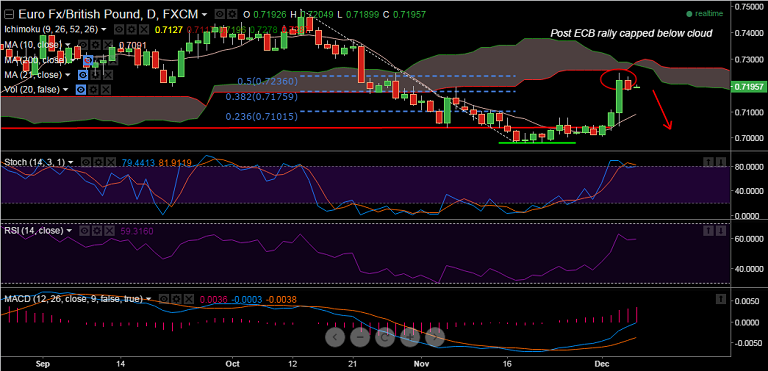

Renewed offered tone around the single currency keeps EUR/GBP on a weaker footing at the beginning of the week. The pair was rejected at day's highs by 0.7205

- Rally in the cross post ECB was capped below the daily cloud supporting a resumption of the downtrend. Breaks below 0.7175 (38.2 % Fibo of Oct 13 to Nov 17 fall) could take the pair lower to 0.7100 levels

- Further support on the downside is thin until the 10/21 DMAs at 0.7075/0.7064, break below could open up lower levels again. Immediate resistance is seen at 0.7236 (50 % Fibo of Oct 13 to Nov 17 fall)

- Markets see scope for further ECB easing in March and BoE rate hike likely in 2016. Contrasting ECB/BoE monetary policy outlooks may keep cross largely contained below 0.7250 (Oct 28 high)

- Later in the day, BOE Governor Carney's testimony will be closely monitored for fresh cues on the BOE interest rates outlook, while the Sentix index will be the main highlight in Euroland

Recommendation: Good to sell rallies around 0.72 levels, SL: 0.7250, TP: 0.7110