EUR/JPY trades higher on weak yen. It hit an intraday high of 163.48 and is currently trading around 163.40. Intraday outlook is bullish as long as the support of 161.50 holds.

April 2025 advance CPI records a month-to-month rise of +0.4%, a notch higher than March's +0.3%, with headline CPI standing at +2.1% YoY, higher than the expected +2.0%. The inflation in goods was at -0.5% YoY, led by a -5.4% fall in energy prices, as services inflation is faster at +3.9% YoY. Core CPI, excluding food and energy, increased to +2.9% YoY from +2.6% in March, showing persisting underlying price pressures. More expensive services balance out deflation in energy, powering total monthly expansion

Technical Analysis:

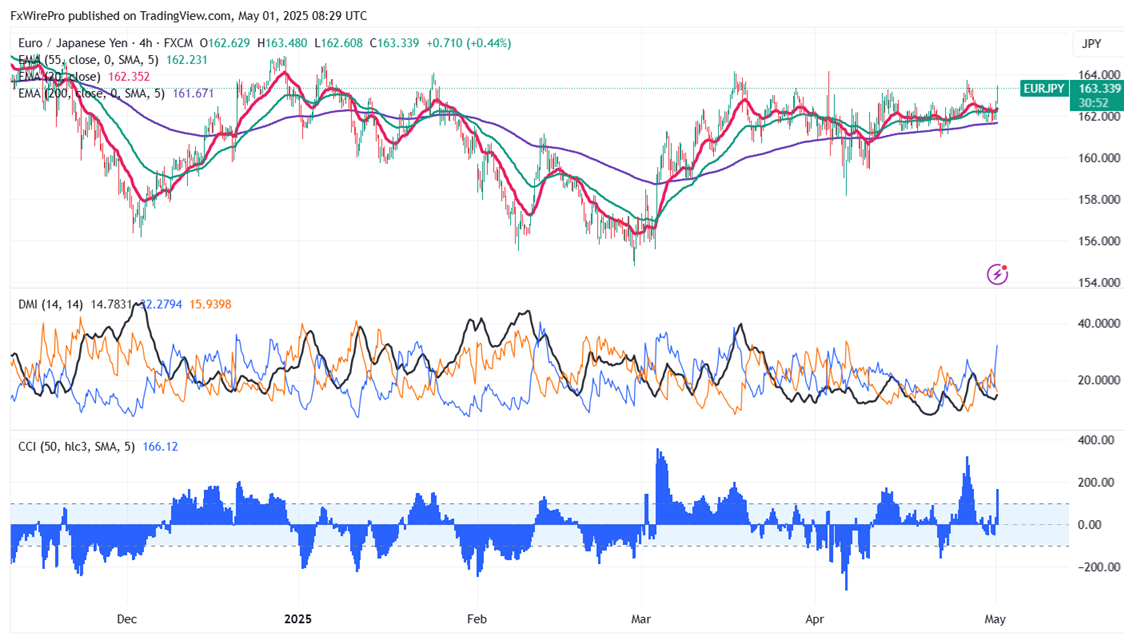

The EUR/JPY pair is trading above 34, below 55 EMA and above 200-4H EMA on the 4- hour chart.

- Near-Term Resistance: Around 163.50 a breakout here could lead to targets at 163.75/164.20/165/166.65/167.

- Immediate Support: At 162.79 if breached, the pair could fall to 162/ 161.49/160.50/160/ 159.25/158.85/158.25.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Bullish

Overall, the indicators suggest bullish trend

Trading Recommendation:

It is good to buy on dips around 163 with a stop loss at 162 for a TP of 165.