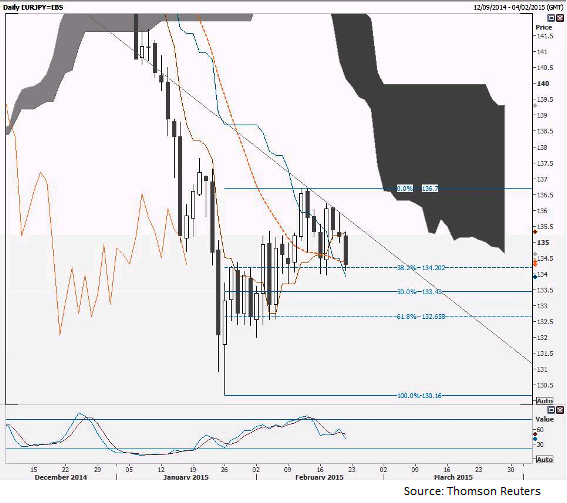

- Cross extends south. The kijun line is just below market at 133.90 and dropping

- The 50% fibo of the 130.16/136.70 move supports below at 133.43

- Day trend indicators show continuous downside risk

- Looks to use corrective rebounds below the trendline as selling opportunities

- Trendline is from Dec 12 136.70 highs and comes in at 135.78 today