EUR/USD pared most of its gains after a cautious approach by the Fed. It hits an intraday low of 1.15649 and is currently trading around 1.15709. Intraday trend remains neutral as long as resistance 1.1670 holds.

On October 30, 2025, the European Central Bank kept its main interest rates steady for the third straight meeting, retaining the deposit facility rate at With inflation hovering near its 2% medium-term objective at 2.2% in September, 2.0% and the primary refinancing rate at 2.15%. The ECB gave confidence. in eurozone resilience in the face of international trade tensions, President Lagarde stressed a data-dependent, meeting-by-meeting approach while keeping all policy alternatives open, albeit senior officials have showed better-than-expected growth of 0.2% in Q3, fueled by Even as manufacturing suffers from tariffs and lower export orders, strong domestic services, healthy private sector balance sheets, and robust labor markets help to support it.

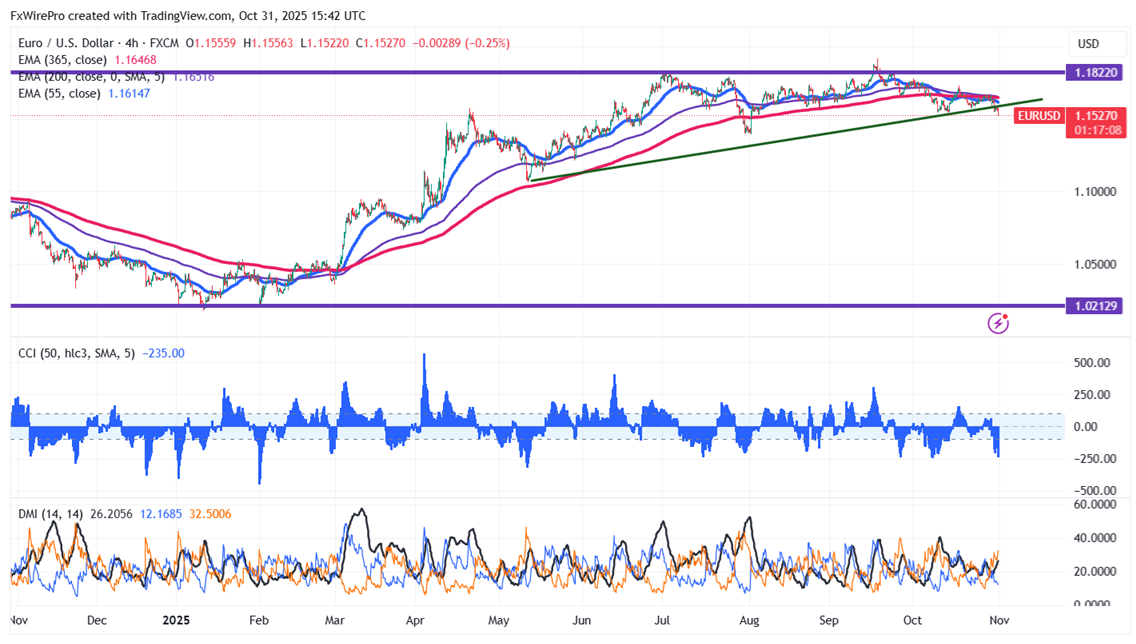

The pair is holding below the 55 EMA, 200 EMA, and 365 EMA in the 4-hour chart. Near-term resistance is seen at 1.1600, a break above this may push the pair to targets of 1.1670/1.1700/1.1765/1800/1.1835/1.1850/1.1920. On the downside, support is seen at 1.1540; any violation below will drag the pair to 1.1480/1.1435.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Bearish

It is good to sell on rallies around 1.1618-20 with a stop-loss at 1.1670 for a target price of 1.1500.