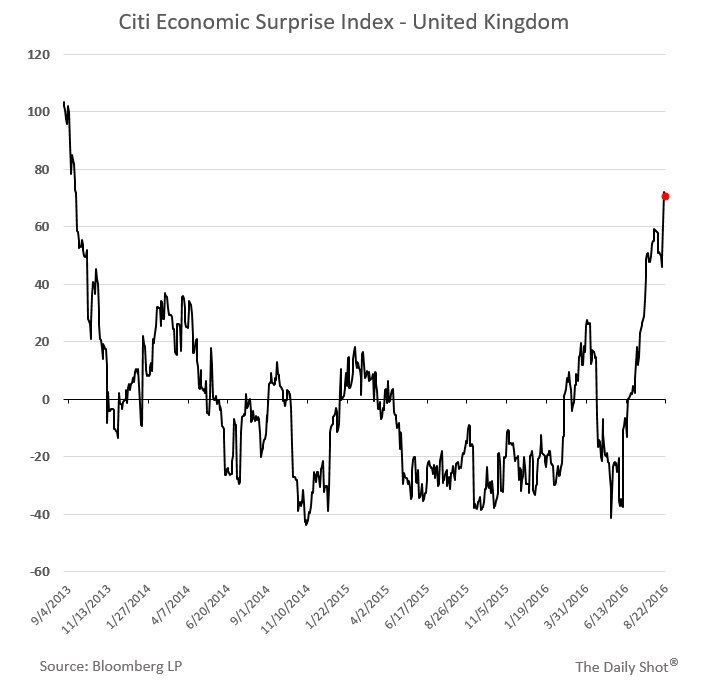

While the United Kingdom has been surprising the markets, economist and the doomsayers with continued resilience after the referendum in June, on the other side of the world the United States’ economic performance has taken a slide compared to the prevalence expectations. Citi’s UK economic surprise index has reached the highest level in almost three years but the economic surprise index in the United States has taken a downturn since July.

Though, two central banks are on a different path of monetary policy. The Bank of England (BoE) has recently unveiled a fresh package of stimulus measures, whereas the Federal Reserve is looking to hike interest rates. With economic surprises diverging, the market expectations of the monetary policy divergence are likely to slide and provide support to the GBP/USD exchange rate and even lead to a recovery.

The pound is currently trading at 1.323 against the dollar, a break above 1.34 are could push the pair towards 1.38

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election