The Lonnie's 13% depreciation against the US dollar in last year till date was a forthright progression of modification to the terms-of-trade shock that has distressed the broader commodity currency block.

Emphasizing this modification has been a BoC's framework and policy implementation that has documented and armoured currency weakening as a primary mechanism for adjusting to the ToT shock.

What does BoC emphasizing for: Although central bank bats for an inflation levelling administration, it has often reiterated that the sympathetic weakening of the currency with oil prices was a key mechanism for rebalancing of resources from the energy sector towards the non-energy export sector, something necessary in order to tolerate the deflationary risks from this ToT shock.

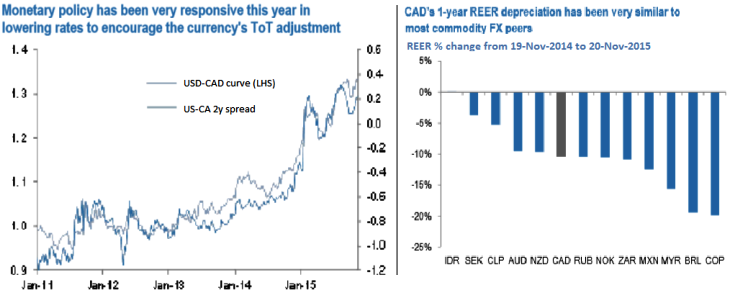

And it has conducted interest rate policy in support of this process - when the non-energy sector looked to fail to respond to the stimulus of a weaker currency in the middle of this year, BoC cut rates further in July.

With USD-CAD remaining coupled with US-Canada 2y rate spreads, this cut helped promote the 10% further depreciation of CAD in the month following the cut.

While there is historical example of such divergence in the past, for example the 2003-2004 period where CAD followed the oil price higher, rather than CAD rates spreads (which lagged the US hike cycle) lower.

There are enough differences between the macro backdrop then and now, that we cannot expect CAD to behave in similar fashion in the coming year.

Monetary policy has been very responsive this year in lowering rates to encourage the currency's ToT adjustment.

Oil and yield spreads set to diverge once again, acting on CAD less uniformly.

Effectiveness of BoC’s monetary policy - CAD eying on global oil price recovery

Wednesday, December 9, 2015 12:49 PM UTC

Editor's Picks

- Market Data

Most Popular

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth