After declining for 10 consecutive months, US import prices rose 1.3% m/m in May, somewhat stronger than consensus expectations (+0.8%), as prices for imported petroleum products jumped higher. Petroleum and petroleum product prices rose 12.7% m/m in May. Excluding this effect, non-petroleum import prices were unchanged on the month (0.0% m/m; -2.6% y/y).

Following sizable price declines in April, food and beverage prices increased modestly (0.3% m/m) and prices for consumer goods stabilized (0.0% m/m). Prices for capital goods continued to fall (-0.2% m/m), although at a slower rate than in April (-0.3% m/m).

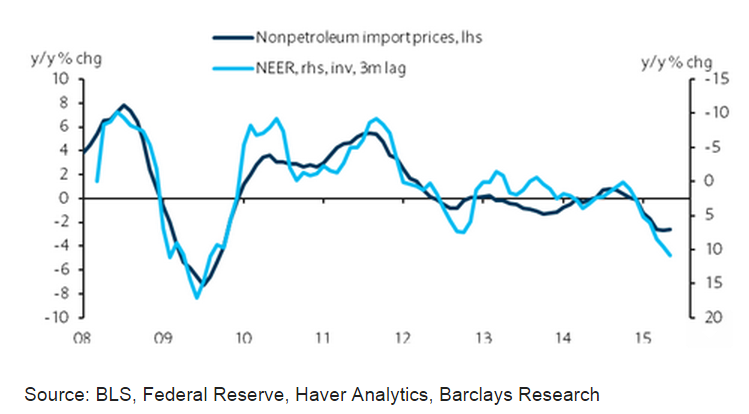

"Overall, this report is consistent with our view that downward pressures on imported core inflation from the lagged effects of a stronger dollar will begin to wane in the third quarter, further reducing headwinds for domestic core prices. The stage is now set for a gradual near-term rebound in domestic inflation that should support confidence among FOMC members that inflation will indeed rise toward their 2% target over the medium term." said Barclays in a report

Effects of dollar appreciation on import prices are starting to wane

Thursday, June 11, 2015 3:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX