This year natural gas price has dropped well below $2/mmbtu, observed during 2012 trough and still sliding further. Today price is down another -2.2%, trading at $1.77/mmbtu. Price has dropped to lowest levels since 1999.

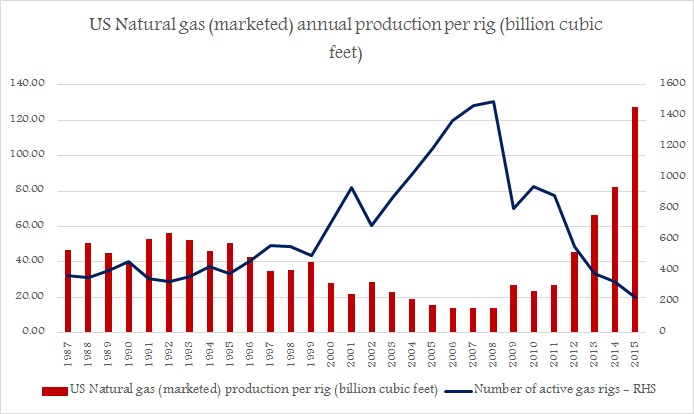

While price has been declining, so has been active gas rigs in U.S, which has been cited by many in recent past, why natural gas prices will recover from here. According to latest count, active gas rigs, have fallen to lowest ever to 92. So far, in 2016 number of active rigs on an average has declined to 109, compared to last year’s 226. After reaching its annual peak (1491) in 2008, number of active rigs are down about 90%.

Despite this decline, our analysis shows, inferring bullish future from rigs decline may not hold true.

Reason is efficiency.

While number of operating rigs, have reached lowest on record, efficiency of each rig has reached record high. Leading to net increase in natural gas production.

Back in 2008, when number of rigs operating reached record high, each rig was producing about 14.16 billion cubic feet of natural gas per annum. Compared to that, in 2016, each rig is producing more than 200 billion cubic feet of gas per annum. That’s about 16 fold increase in efficiency.

So it is likely that natural gas hasn’t reached its production efficiency peak and neither has its price reached bottom.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022