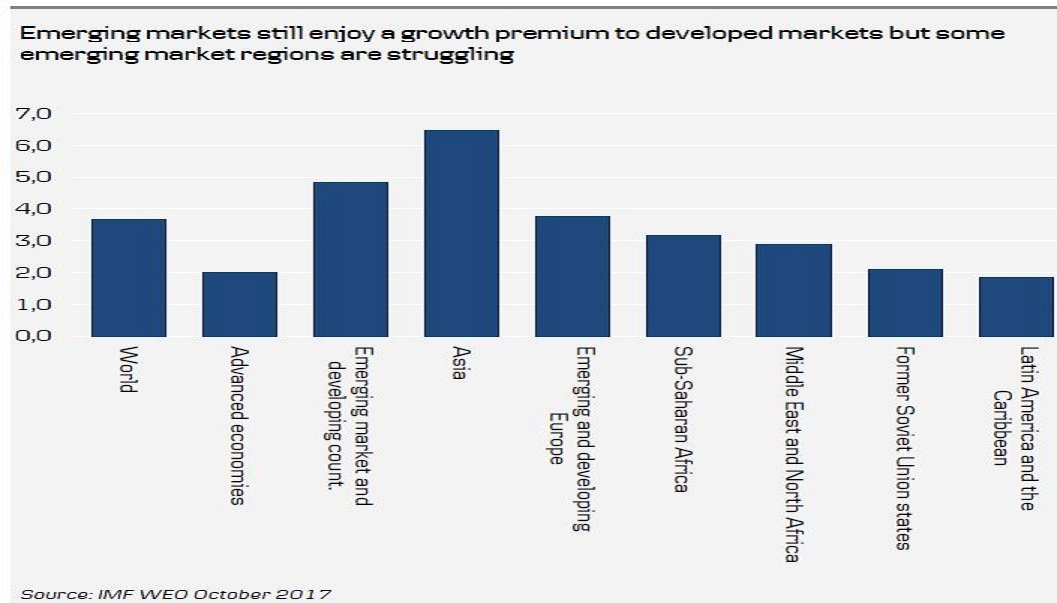

The emerging market economies are expected to witness an average growth of 5 percent over the next two years, according to a recent report from Danske Bank. While advanced economies should be happy to record an average growth rate of 2 percent over the next two years, emerging markets are expected to witness almost 5 percent on average. The strongest growth outlook is in Asian countries but Eastern European and African countries are also expected to grow quickly.

In contrast, Russia and the rest of the former Soviet Union are struggling with a relatively weak growth outlook, as are many Latin American countries. Among the most uplifting meetings at the meetings was the one on India, where the IMF projects the economy’s growth potential is around 7.5 percent thanks to a relatively young population, structural reforms (tax reform and bank re-capitalization), relatively low debt (in contrast with China) and macroeconomic stability.

The same goes more or less for the Indonesian economy. In contrast, the IMF saw relatively subdued long-term growth potential for the Russian economy (due to weak productivity growth (due to state controls in the economy) and a declining population), Brazil (where the debt overhang from the boom years in the private sector is weighing on growth) and South Africa (given structural and fiscal obstacles).

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal