Emerging market (EM) crisis and falling values of EM currencies have started taking toll on Japan and Bank of Japan's (BOJ) monetary policy.

Japan's borrowing cost was already at historical low, when Bank of Japan (BOJ) introduced its massive quantitative purchases and increased it on 2014, finally to ¥80 trillion.

So rather than lowering the cost of borrowings, BOJ's easing led to massive rise in price of assets namely in equities, further rallies in government bonds and finally weakened Yen against all of its major trade partners.

Competitiveness rose sharply for Japanese products across global markets improving both trade balance and mainly companies' profits.

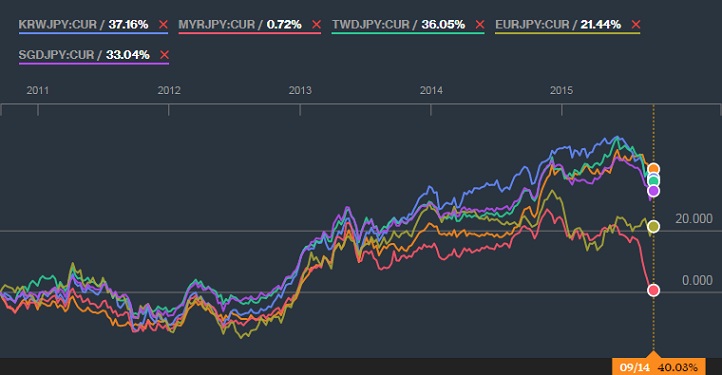

This theme suffered major setback in 2014/15 as other currencies, especially emerging market ones started suffering depreciation, reducing Yen's advantage and as European Central Bank (ECB) introduced asset purchase program.

- Yen, which was down almost 35% against Euro in past 5 years are now down just about 20%, while Malaysian Ringgit has wiped out its entire gain against Yen. Stories are similar for most of EM currencies and also for some developed ones, such as Australian Dollar, which was at one point in past five years was up almost 30% against Yen is now up just about 6.5%.

This is likely to create dilemma for BOJ, as it risks massive currency war if it expands its asset purchase program further.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?