- Emerging markets faced a miniature currency crisis at the first hint of tightening in the US in 2013 by then Federal Reserve (FED) chairman Ben Bernanke.

- Most hit were India, Turkey, South Africa & Indonesia where in India currency depreciation was close to 30%.

- Since then the FED has taken a patient approach and the emerging markets enabled reforms and prepared for the inevitable tightening of policy.

- Nevertheless a severe loophole remains, that is the corporate sector. During the financial crisis as the interest rate fell to record low, the corporates have gobbled up foreign loans especially in US dollar.

- The Governments even if have sufficient reserve, will be less willing to cover up for the corporates if the loans get sour as interest cost rises.

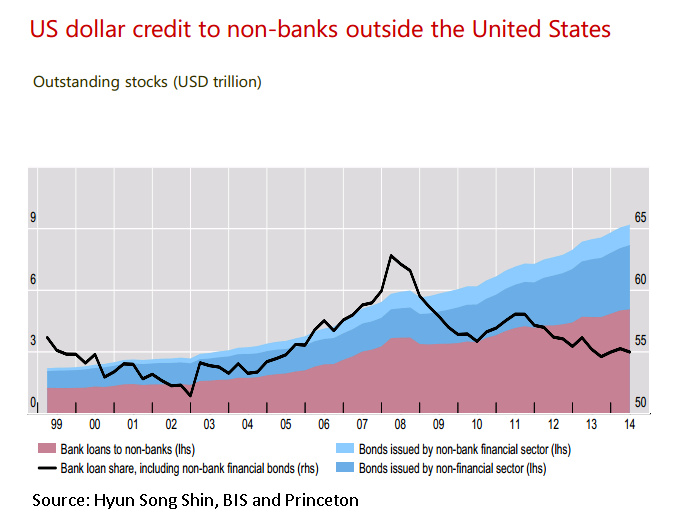

- Recent BIS study shows that such dollar loans are close to $ 65 trillion in value.

- This trend is seen, since the value of dollar fell after 1999, but recently it has broken its long term bearish trend that was in play since 2001.

So far, since the mid 2014 emerging currencies have fared well compared to developed markets, against the dollar but the party could get sour once the rate start rising.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand