Bitcoin attempts to bounce back from the seven-month low of $5,755 today, but as sellers continued to dominate, the trend goes in narrow range.

Bearish trend of BTCUSD has prolonged from the peaks of $7,767 levels to the current $6,159 levels.

Those who want to enjoy the Bitcoin’s bear market, can test their luck into the newly invented bitcoin derivatives contracts on CME and CBOE.

Bitcoin futures offer an instant, cost-effective method of crypto trade markets. They are standardized contracts to buy or sell a particular asset at a set price, on a set date in the future, in predefined quantity and quality.

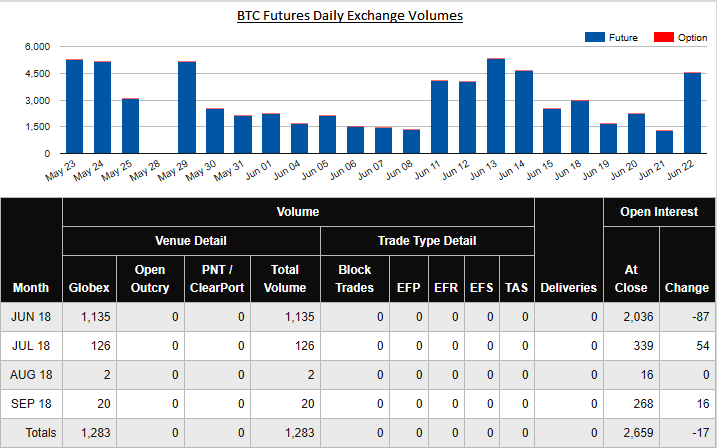

Open interest represents the total number of contracts either long or short that have been entered into and not yet offset by delivery. As you could observe total number of open interest of BTC futures contracts of all tenors that is reduced (-17), the market sentiment in this underlying asset is reduced. Each open transaction has a buyer and seller, but for calculation of open interest, only one side of the contract is counted.

Traders across the globe bet on futures to rationally reduce risk or seek profits on changing markets without difficulty.

Contract Unit: 5 bitcoin, as defined by the CME CF Bitcoin Reference Rate (BRR)

Outright: $5.00 per bitcoin = $25.00 per contract

Calendar Spread: $1.00 per bitcoin = $5.00 per contract

Trading Hours: CME Globex and CME ClearPort: 5:00 p.m. – 4:00 p.m. CT Sunday – Friday

Product Code: Outright: BTC

Listing Cycle: Nearest 2 months in the March Quarterly cycle (Mar, Jun, Sep, Dec) plus the nearest 2 "serial" months not in the March Quarterly cycle. Courtesy: CME website

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -59 levels (bearish), while hourly USD spot index was at -85 (bearish) while articulating at 10:03 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary