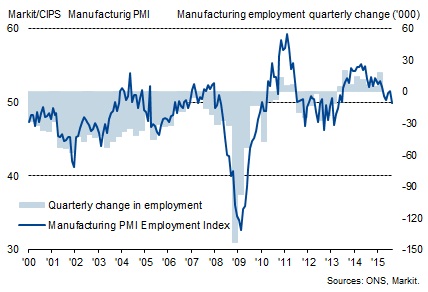

Latest report from Markit economics pointing to sharp employment deterioration in UK's manufacturing sector. Sector is likely to shed jobs going ahead, putting dent over UK's manufacturing recovery.

- Latest PMI report showed, overall manufacturing expansion remained subdued in August in spite strong growth in consumer goods segment. Headline PMI dipped further to 51.5 in August from 51.9 in July, well below last 30 months average expansion.

- Strong growth in domestic market is providing the necessary support, while export orders are down thanks to stronger pound and economic slowdown in China.

However latest slowdown in manufacturing activity is unlikely to change outlook of rate hike from Bank of England (BOE) as UK's economy relies more on export of services than manufacturing and services sector remains major employment provider.

Nevertheless, stronger pound's impact on the sector would be considered by BOE officials and ways to mitigate further rise of Pound while BOE prepares to hike rates.

Pound is currently trading at 1.532 against Dollar.

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth