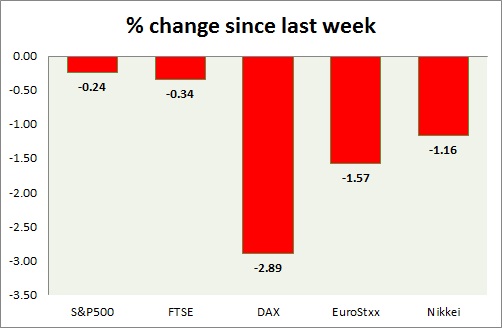

Equities are giving up gains ahead of FOMC today as investors resort to profit booking. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark continues to lose ground after it failed to break above the resistance. MBA mortgage applications are further down by -3.9% accelerating over previous -1.3%. SPX500 is currently trading at 2068, down 0.3% for the day. Immediate support lies at 2040, 1985 and resistance 2081, 2102.

- FTSE - FTSE, best performer this week, gained big time today after weak data fueled prospects of continued loose policy by BOE. FTSE is trading at 6923, up 1.26% for the day. Gain accelerated over short covering. FTSE looks like will be testing the high once again. Support lies at 6720 and resistance near 6965, 7010.

- DAX - DAX, is hit by further profit booking ahead of FOMC tomorrow after weeks of rally. Germany today sold 10 year bund at record low of just 25 basis points. DAX is currently trading at 11930, down by 0.43% today. Immediate support lies at 11740, 11390.

- EuroStxx50 - Stocks across Europe is seeing sell over profit booking before today's FOMC. Germany is down (-0.43%), France's CAC40 is down (-0.10%), and Italy's FTSE MIB is down (-0.90%) whereas Spain's IBEX is up (0.10%). EuroStxx50 is currently trading at 3671, down 0.2% for the day. Support lies at 3635, 3555.

- Nikkei - Nikkei is trading above 19500 as it loses correlation with Yen. Nikkei might move towards its target of 20,800. Nikkei is trading at 19500. Immediate support lies at 19380, 19000.

|

S&P500 |

0.88% |

|

FTSE |

2.41% |

|

DAX |

-0.12% |

|

EuroStxx50 |

0.08% |

|

Nikkei |

1.18% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary