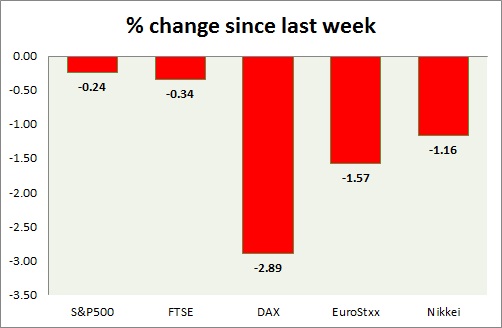

Today is a risk off day for global equities so far. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark is trading flat today, facing headwinds over stronger US dollar.

- S&P case shiller home prices grew 4.6% in January.

- Chicago PMI continue to pose weakness, came at 46.3.

- Core PCE price index remained stable growing at 1.4% YoY.

- Redbook index grew 3% YoY and 1.2% mom.

- Consumer confidence rose above 100, came at 101.3 compared to prior 98.8.

- SPX500 is currently trading at 2079, down 0.111% for the day. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE shredded yesterday's gain as better than expected GDP gave rise to concern over BOE rate hike.

- FTSE is currently trading at 6800, down 1.30% today. Immediate support lies at 6700 and resistance at 9665 and 7060.

DAX -

- DAX fell today as part of pan European sell off. Investors remain worried about Greek outcome.

- German retail sales grew 3.6% YoY, however fell -0.5% mom.

- Unemployment rate fell to 6.4%

- DAX is trading at 12012, down near 0.66% today. Immediate support lies at 11750, 11600 and resistance at 12080, 12200.

EuroStxx50 -

- Stocks across Europe are red today.

- Germany is down (-0.60%), France's CAC40 is down (-0.53%), Italy's FTSE MIB is down (-0.26%) and Spain's IBEX is down (-0.10%).

- EuroStxx50 is currently trading at 3705, down -0.60% today. Bias is upwards. Support lies at 3635, 3545.

Nikkei -

- Nikkei is once again testing the support area. Weaker Yen failed to induce rally so far. Investors remain cautious over weaker growth prospect in Japan.

- Nikkei is currently trading at 19268. Immediate support lies at 19220, 18540 and resistance at 19730, 19920.

|

S&P500 |

+0.89% |

|

FTSE |

-0.96% |

|

DAX |

+1.21% |

|

EuroStxx50 |

+0.62% |

|

Nikkei |

-0.48% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand