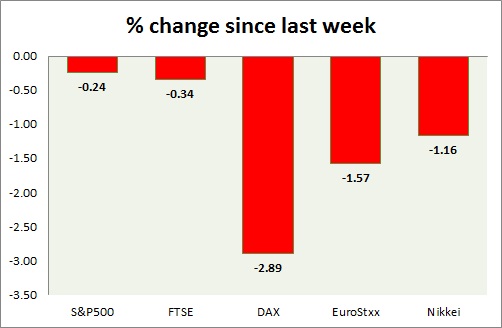

Equities are all trading in green today, driven by encouraging words from ECB president Mario Draghi. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark jumped back from yesterday's loss as 2080 area provided interim support. S&P500 bounced back above 2100, now it is for the bulls to curve in a new high or keep struggling.

- Empire state manufacturing index dropped to -1.19 from 6.90 prior.

- Industrial production dropped -0.6%.

- NAHB housing market index improved to 56 from 52 prior.

- S&P 500 is currently trading at 2106, up 0.40% today. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE has broken above 7100 area, up 0.4% today. FTSE stands as best performer this week so far. Further rise might be on order, however profit bookings would keep hindering rapid rise.

- FTSE is currently trading at 7073. Important support lies at 6950, 6700.

DAX -

- DAX is up today as ECB President Mario Draghi pledged to keep assistance in place.

- Index is trading at 12290, up nearly 0.5% today. Immediate support lies at 12000, 11830, 11750.

EuroStxx50 -

- Stocks across Europe are in green today as ECB kept monetary policy accommodative and have pledged to keep it so for the time being.

- Germany is up (+0.53%), France's CAC40 is up (+0.86%), Italy's FTSE MIB is up (+1.1%) and Spain's IBEX is up (+0.61%).

- Consumer prices in France remained flat y/y in Fenruary and grew 0.7% m/m.

- EuroStxx50 is currently trading at 3813, up 0.42% today. Broader trend remains upwards. Support lies at 3635, 3545.

Nikkei -

- Profit snapped back from two days of profit booking. Yen movement is not impacting the index much.

- Industrial production dropped -3.2% m/m in March and dropped -2% y/y.

- Nikkei is currently trading at 19900. Immediate support lies at 19630, 18540 and resistance at 20000, 20800.

|

S&P500 |

+0.14% |

|

FTSE |

+0.24% |

|

DAX |

-0.78% |

|

EuroStxx50 |

-0.21% |

|

Nikkei |

-0.61% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary