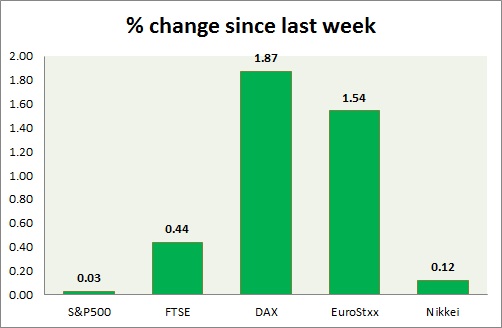

Equities are all trading in green today, with Europe seeming to be more bullish. Performance this week at a glance in chart & table -

S&P 500 -

- S&P traded to new all-time high today, around 2125 area. Higher than expected earnings provided support to S&P.

- Preliminary estimate shows Services PMI will drop to 57.8 from 59.2 prior.

- Dallas FED manufacturing business came at -16 compared to -17.4 last week.

- Falling volatility indicate that further gains might be on card.

- S&P 500 is currently trading at 2118, up +0.03% today. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- FTSE gained ground despite stronger pound, traded above 7100 level, made high around 7122.

- FTSE will be rising further, though upcoming election might provide temporary headwinds.

- Important support lies at 6950, 6700.

DAX -

- DAX has gained back 12000 level, as fears over Greek contagion is starting to fade.

- However short term bulls might face some challenge due to bearish engulfing in weekly chart.

- Index is trading at 12032, up nearly 1.9% today. Immediate support lies at 11600, 11200 and resistance at 12100, 12180, 12360.

EuroStxx50 -

- Stocks across Europe are green today, fueled by risk on theme as market shrugged off Greece related uncertainty.

- Germany is up (+1.9%), France's CAC40 is up (+1.2%), Italy's FTSE MIB is up (+1.36%) and Spain's IBEX is up (+1.17%).

- EuroStxx50 is currently trading at 3770, up 1.6% today. Support lies at 3635, 3545, 3300

Nikkei -

- Nikkei is struggling today, to hold gains above 20000 level. Bank of Japan's (BOJ) neutral stance is providing headwinds.

- Nikkei is currently trading at 20088. Immediate support lies at 19450, 18540 and resistance at 20800.

|

S&P500 |

+0.03% |

|

FTSE |

+0.44% |

|

DAX |

+1.87% |

|

EuroStxx50 |

+1.54% |

|

Nikkei |

+0.12% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?