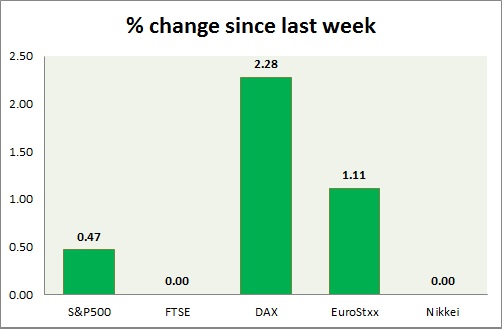

Equities are all trading in green today, after massive selloff of last week. Performance this week at a glance in chart & table -

S&P 500 -

- S&P might be moving to test all time high around 2125, currently trading at 2118 as stock results are surprising to upside.

- ISM New York index for April moved up to 58.1 from 50 prior.

- Factory orders gained 2.1% in March on a monthly basis.

- S&P 500 is currently trading at 2118, up +0.47% today. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE is closed over holiday in UK.

DAX -

- DAX has gained close to 2.2% today, currently trading at 11640.

- Larger trend remains upwards, however price might go down further in short term. Bearish engulfing in weekly chart remains at play. Bears have the potential to push prices as low as 10500.

- German manufacturing for April remained expansionary at 52.1

- Immediate support lies at 10550 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are green today, fueled by pull back theme, after last week's sell offs.

- Germany is up (+2.2%), France's CAC40 is up (+0.97%), Italy's FTSE MIB is up (+1.02%) and Spain's IBEX is up (+0.52%).

- Bears might push E.Stxx50 towards 3300 area.

- EuroStxx50 is currently trading at 3635, up 1.1% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is closed over holiday in Japan.

|

S&P500 |

+0.47% |

|

FTSE |

+0.00% |

|

DAX |

+2.28% |

|

EuroStxx50 |

+1.11% |

|

Nikkei |

+0.00% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate