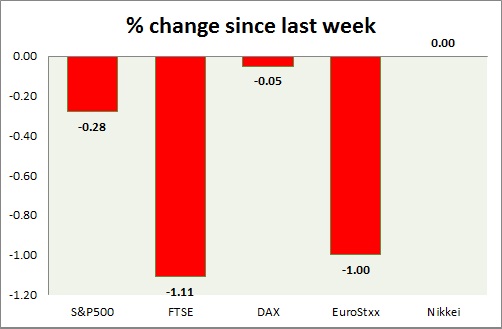

Equities are back in red driven by risk aversion ahead of UK election and default talks over Greece. Performance this week at a glance in chart & table -

S&P 500 -

- S&P once again failed to break into new all-time high.

- US trade balance deteriorated further in March to $-51.4 billion, driven by stronger dollar.

- Redbook index improved further by 0.4% m/m and 1.6% on yearly basis.

- Markit services PMI remained in expansionary territory at 57.4, whereas ISM non-manufacturing PMI improved to 57.8.

- TIPP economic optimism fell to 49.7 from 51.3 prior.

- S&P 500 is currently trading at 2100, down -0.69% today. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE dropped back below 7000, due to election uncertainty amid global sell offs. FTSE stands worst performer so far this week.

- FTSE would trade rang bound with downside bias in the short term driven by election news and negotiation after.

- FTSE is currently trading at 6950, down -0.5% today. key support stands at 6700.

DAX -

- DAX has given up all of yesterday's gain as bears have taken charge and index seem to be continuing last week's fall.

- Larger trend remains upwards, however price might go down further in short term. Bearish engulfing in weekly chart remains at play. Bears have the potential to push prices as low as 10500.

- DAX is currently trading at 11385, down more than 2% today. Immediate support lies at 10550 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are down today, fueled by risk aversion over UK election and Greek default fear.

- Germany is down (+2.02%), France's CAC40 is down (-1.78%), Italy's FTSE MIB is down (-2.7%) and Spain's IBEX is down (-2.8%).

- Bears might push E.Stxx50 towards 3300 area.

- EuroStxx50 is currently

trading at 3543, down 2.3% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is closed over holiday in Japan.

|

S&P500 |

-0.28% |

|

FTSE |

-1.11% |

|

DAX |

-0.05% |

|

EuroStxx50 |

-1.00% |

|

Nikkei |

+0.00% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate