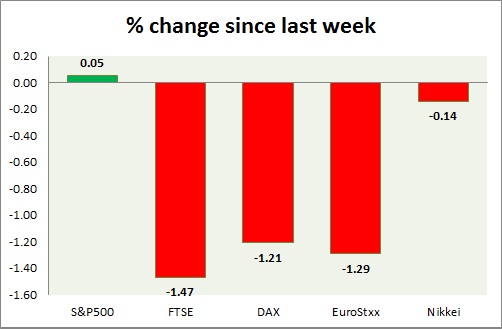

Equities snapped back losses taking lead from S&P. Performance this week at a glance in chart & table -

S&P 500 -

- S&P continue to consolidate around 2115 area.

- Initial jobless claims was better than expected at 264K compared to 275K expected.

- Producer prices dropped -0.4% in April and -0.2% excluding food and energy.

- S&P 500 is currently trading at 2113. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE is clearly lacking momentum failing to break above 7000 level, further selloffs are likely.

- FTSE is currently trading at 6966. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX rose sharply following initial selloffs, however still remains in bearish territory.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart provided the necessary strength to bears. Target coming around 10550, should resistance at 11750 holds.

- DAX is currently trading at 11570. Immediate support lies at 10550 and resistance at 11750, 12080 around.

EuroStxx50 -

- Stocks across Europe are green today, as sentiment turned on risk appetite.

- Germany is up (+1.7%), France's CAC40 is up (+1.3%), Italy's FTSE MIB is up (+1.5%) and Spain's IBEX is up (+0.75%).

- EuroStxx50 is currently trading at 3605, up 1.75% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is worst performer today, as yen has strengthened against dollar.

- Nikkei is currently trading at 19620, further downside is likely should resistance 19750-19850 holds. Price target is coming close to 17800.

- Key support is at 18900, 18400 and resistance at 19750 area.

|

S&P500 |

+0.05% |

|

FTSE |

-1.47% |

|

DAX |

-1.21% |

|

EuroStxx50 |

-1.29% |

|

Nikkei |

-0.14% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand