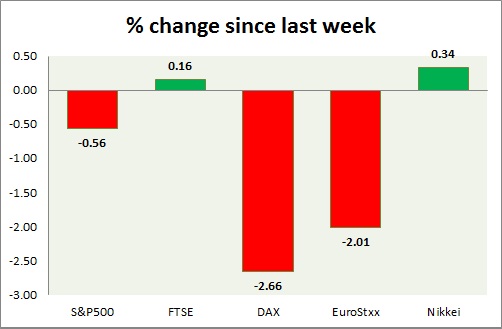

Equities are trading in red today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down as US GDP components shrank and investors withdrew money from US.

- Headline GDP shrank by -0.7%.

- Chicago PMI was sharply lower to 46.2 from 52.3 prior.

- Michigan consumer sentiment improved 90.7 from 88.6 prior.

- S&P 500 is currently trading at 2115. Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE is treading water in spite of global selling. Today's range 7069-7005.

- 7000 seem to be acting as strong support.

- FTSE is currently trading at 7042. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is down heavily as Euro moved up sharply. 11704-11510 today. German retail sales grew by 1% in April from a year ago.

- Larger buy trend remains in place. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11520. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all trading in red today.

- Germany is down (-1.38%), France's CAC40 is down (-1.30%), Italy's FTSE MIB is down (-0.06%) and Spain's IBEX is down (-0.75%).

- EuroStxx50 is currently trading at 3606, down 1.4% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Weaker Yen is providing the necessary support to Nikkei, which remains buoyant in spite of global sell offs.

- Japanese core CPI remain weak, growing just at 0.3% in April from a year ago.

- Nikkei is currently trading at 20428. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

-0.56% |

|

FTSE |

+0.16% |

|

DAX |

-2.66% |

|

EuroStxx50 |

-2.01% |

|

Nikkei |

+0.34% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand