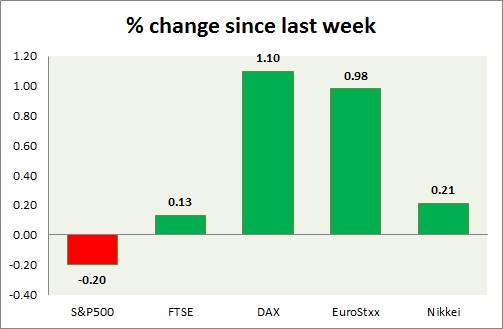

Equities remain mixed over the board facing minor headwinds & profit booking. Performance this week at a glance in chart & table -

- S&P 500 - US stock indices sailed further into record highs after comments from FED president Janet Yellen. S&P 500 is mainly suffering from portfolio adjustments. Comments from Yellen remain at focus. It is currently trading at 2113, down 0.11% for the day. It's at all-time high, immediate support lies at 2084.

- FTSE - FTSE continue to fail to close above its all-time high. Portfolio adjustment & outflows in the face of hawkish central bank are keeping the bulls at bay. It's playing at its all-time high and trying to break above 7000. FTSE is currently trading at 6923. Support lies at 6840.

- DAX - German index remained a top performer and an investor darling, breaking into new highs. DAX is currently trading at 11194, down 0.1% for the day. It's breaking into new all-time high, support lies at 10980.

- EuroStxx50 - European stock index is trailing due to mixed performance from stocks and different Euro zone markets. France consumer confidence data released today showed improvement to 92 from a prior 90. EuroStxx50 is currently trading at 3537 down 0.4% for the day. Support lies at 3387.

- Nikkei - Nikkei is flat today, falling 0.10% on the back of a stronger yen. Nikkei is currently trading at 18585. Immediate support lies at 18380.

|

S&P500 |

0.19% |

|

FTSE |

-0.36% |

|

DAX |

0.75% |

|

EuroStxx |

0.45% |

|

Nikkei |

0.37% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary