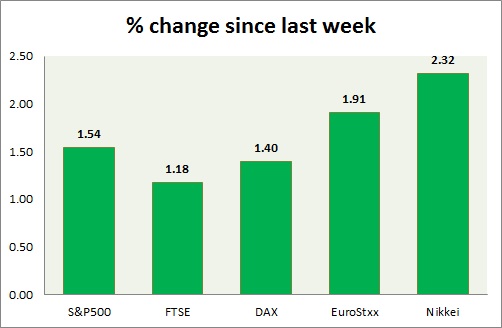

Equities are all giving small movement today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P once again broke above 2100 area, but marginally down today.

- Empire state manufacturing rose to 3.86 in July from -1.98 prior.

- Producer price index excluding food and energy rose 0.3% in June on monthly basis.

- Industrial production rose by 0.3% m/m in June.

- S&P 500 is currently trading at 2109. Immediate support lies at 1980, 2040 and resistance 2100.

FTSE -

- FTSE is trading in green today. Today's range 6730-6775.

- Unemployment rate rose to 5.6% in May for three months. Wages rose by 2.8% excluding bonus and 3.2% including it.

- 6750-6770 area, proving to be crucial resistance.

- FTSE is currently trading at 6760. Immediate support lies at, 6050 and resistance at 7000.

DAX -

- DAX is again marginally up today, as investors remain cautious before ECB payment on 20th July.

- German 10 year bond was sold at highest yield 0f 0.88% since October last year.

- DAX is currently trading at 11550. Immediate support lies at, 10500 and resistance at 11590, 12100 around.

EuroStxx50 -

- Stocks across Europe are all trading in green, as investors flock into European assets.

- Germany is up (+0.28%), France's CAC40 is up (+0.24%), Italy's FTSE MIB is up (+1.08%), Portugal's PSI 20 is up (+0.34%), Spain's IBEX is up (+0.90%)

- EuroStxx50 is currently trading at 3623, up by +0.2% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is the best performer this week so far. Weaker Yen is likely to push the index higher.

- Nikkei is currently trading at 20550. Key support is at 20000 and resistance at 21000 area.

|

S&P500 |

+1.54% |

|

FTSE |

+1.18% |

|

DAX |

+1.40% |

|

EuroStxx50 |

+1.91% |

|

Nikkei |

+2.32% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand