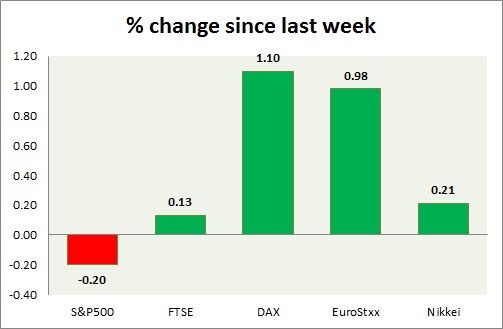

Equities gained last night in New York session and as of today's trading performance remain mixed. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark moved to new highs last night but so far has failed to gain ground above that so far today. S&P 500 is currently trailing NASDAQ that could be a sign of further speculative flow. Currently trading at 2111 and remain mixed on the outlook. Immediate support lies at 2084.

- FTSE - FTSE has failed to gain traction over improving construction PMI above 60 and remains concerned over the upcoming higher cost of capital. Prices seem to be failing near the all-time high and may correct lower. FTSE is currently trading at 6920. Support lies at 6870 and facing resistance near 6965.

- DAX - DAX again is Europe's top performer this month and may continue the path as Germany remains robust. Retail sales data released today showed activity improved at a solid 2.9% mom. DAX is currently trading at 11391. Immediate support lies at 11180. 11520 areas could provide some resistance ahead.

- EuroStxx50 - EuroStxx is continuing its sideways trade with bullish bias as the overall Euro zone performance remained mix. German data showing solid gains whereas Spanish employment deteriorated. Employment fell by 13,500. EuroStxx50 is currently trading at 3579. Support lies at 3520.

- Nikkei - Nikkei dropped sharply in today's trading as Esturo Honda, economic adviser of the Prime Minister warned BOJ against further increase in pace of asset purchase. Yen has also gained over the comments. Nikkei is trading at 18741. Immediate support lies at 18500.

|

S&P500 |

0.22% |

|

FTSE |

-0.40% |

|

DAX |

0.11% |

|

EuroStxx |

-0.22% |

|

Nikkei |

-0.64% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary