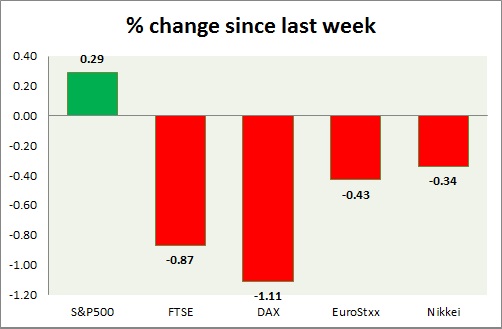

Equities are broadly trading in red today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is marginally lower today. Today's range 2096-2107.

- Building permits dropped to 1.12 million from 1.34 million in June.

- Housing starts rose to 1.21 million in July from 1.204 million prior.

- S&P 500 is currently trading at 2097. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE marginally lower, with mining stocks under heavy selling. FTSE has wiped up this year's entire gains and has moved into red. Today's range 6570-6503.

- FTSE is currently trading at 6560. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is marginally lower to again today. Today's range 10980-10880.

- DAX is currently trading at 10920. Immediate support lies at, 10500 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are mixed to start the week.

- Germany is down (-0.22%), France's CAC40 is down (-0.20%), Italy's FTSE MIB is flat Portugal's PSI 20 is down (-0.15%), Spain's IBEX is down (-0.15%)

- EuroStxx50 is currently trading at 3496, down by -0.37% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is weaker today as Chinese stocks faced heavy selling of -6.15% again today.

- Nikkei is currently trading at 20510, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.29% |

|

FTSE |

-0.87% |

|

DAX |

-1.11% |

|

EuroStxx50 |

-0.43% |

|

Nikkei |

-0.34% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate