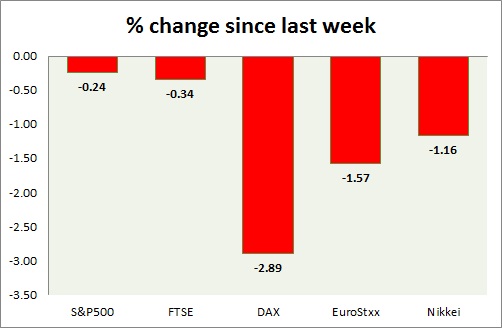

Last week's non-farm report cleared that divergence exist in the equity market. German stock index continued gains whereas US equities faltered. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark is gaining some grounds after Friday's big selloff after the release of NFP report. US labor market condition deteriorated in February to 4.0 compared to previous 4.9. Further losses can't be ruled out as key support is broken. S&P 500 is currently trading at 2079. Immediate support lies at 2040 and resistance 2086, 2103.

- FTSE - FTSE continues to lose further ground in today's trading after another sell off from the all-time high levels. FTSE is trading near its key support at 6876. Support lies at 6870, 6800 and resistance near 6965.

- DAX - DAX, star performer of the month, continues to rise despite fall in other major indices across globe. Strong NFP report failed to move risk aversion sentiment as the index is cheering today's better than expected Sentix confidence data. DAX is currently trading at 11581. Immediate support lies at 11180.

- EuroStxx50 - Stock performance is mixed across Europe. Germany is up (0.30%), France's CAC40 is down (- 0.45%), and Italy's FTSE MIB is up (0.50%) whereas Spain's IBEX is down (- 0.35%). EuroStxx is currently trading at 3610, up 0.20% for the day. Support lies at 3540.

- Nikkei - Nikkei gave in to risk aversion and weaker than expected GDP growth at 0.4% however gaining grounds in futures trading. Weaker Yen failed to provide much support. The index is trading at 18853. Immediate support lies at 18500 and resistance at 19000.

|

S&P500 |

0.34% |

|

FTSE |

-0.07% |

|

DAX |

0.62% |

|

EuroStxx |

0.19% |

|

Nikkei |

0.05% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary