A strong surge in institutional and retail demand for Ethereum propelled the record weekly inflows of $2. 18 billion into Ethereum ETFs between July 14 and July 18, 2025, marking the tenth straight week of positive ETF inflows and creating a new all-time high for Ethereum-based exchange-traded products. With BlackRock's ETHA fund receiving the most allocation of $1. 76 billion, this inflow has pushed Ethereum above $3,800 and helped to produce its best monthly increases in three years. Analysts, including Bernstein, forecast this trend to speed as major banks and fintech firms keep buying ETH for balance sheet exposure and as infrastructure for new financial products, classifying Ethereum "the next institutional darling. " With some experts predicting targets of $10,000–$15,000 by year-end, this sustained institutional purchase, together with Ethereum's central position in tokenized real-world assets and next-generation payment network,s is expected to drive ETH prices even further. With institutional investors progressively favoring Ethereum ETFs for their accessibility and regulatory clarity as opposed to other crypto funds, these huge inflows indicate a major change toward mainstream acceptance of Ethereum assets.

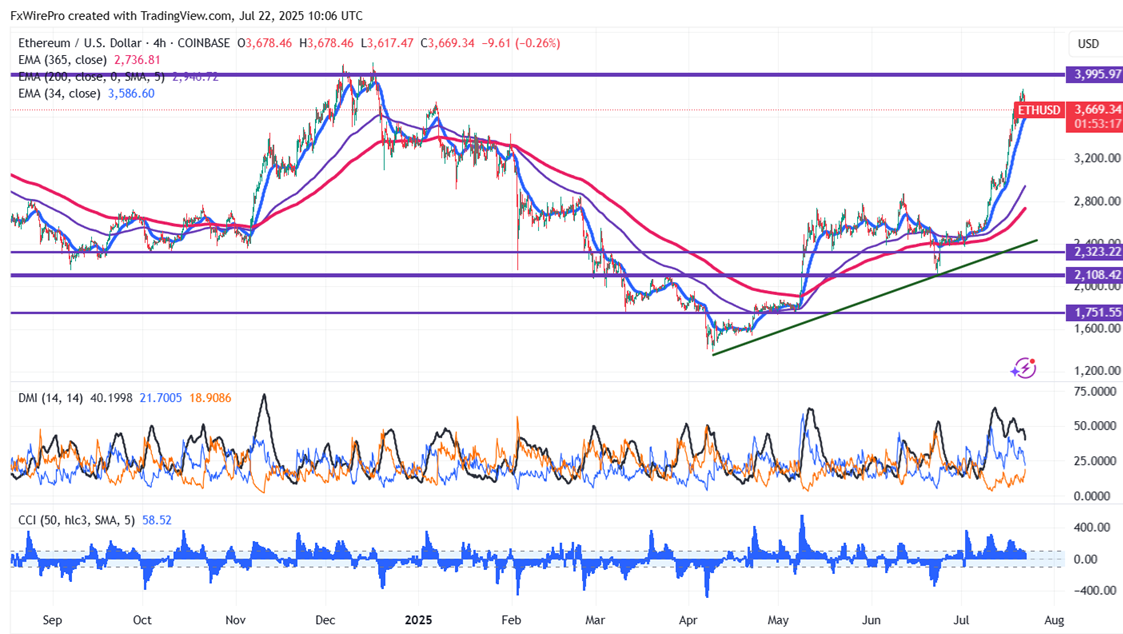

ETHUSD pared some of its gains after hitting a multi-month high. It hit an intraday high of $3860 and is currently trading around $3667.

Overall trend remains bullish as long as support $2000 remains intact. Watch out for $4000, any break above targets $5000. A robust bullish trend will only materialize above $5000.

Immediate support is around $3400. Any violation below will drag the price down to $3200/$3000/$2880/$2770/$2650/$2534/$2435/$2374/$2000/$1750/$1675/$1620/$1500/$1200/$1000. A breach below $1000 could see Ethereum plummet to $800/$500.

It is good to buy on dips around $3400 with SL around $3150 for a TP of $4100.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary