An Ethereum whale from the 2014 ICO recently sold 3,000 ETH for about $7.64 million on October 24, 2024, following a previous sale of 7,000 ETH in July that led to a 15% price drop. After this latest transaction, the whale still holds approximately 37,070 ETH, valued around $93.8 million. Initially, they acquired 254,908 ETH for just $79,000, with the current total worth exceeding $646 million. Since this recent sale, Ethereum's price has decreased by about 2.15%.

Bearish Outlook Signals: Negative Coinbase Premium Index for Ethereum

The negative ETH Coinbase Premium Index, now at -2, suggests that U.S. institutional investors and whales are actively selling their ETH. This observation is reinforced by data indicating both accumulation and substantial selling by whales and retail investors, pointing to a bearish short-term forecast for ETH.

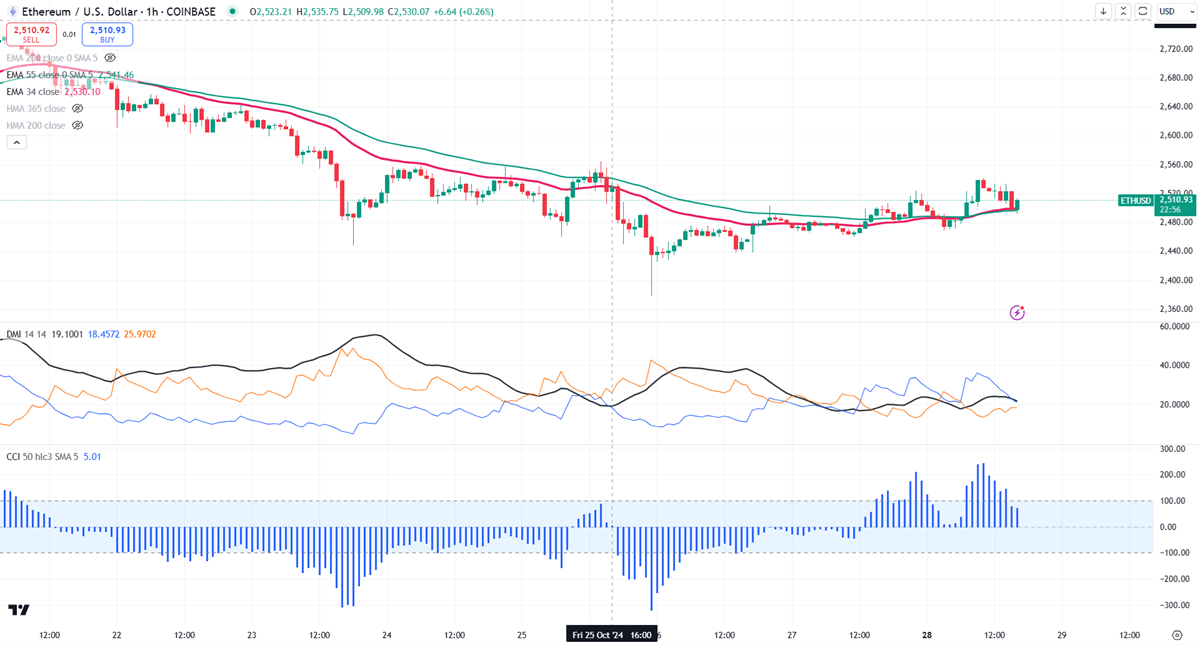

Technical Analysis: Resistance and Support Levels for Ethereum

Bullish momentum may be achievable if Ethereum maintains above 2,770. The key near-term resistance is at \2,770, with significant upward movement targeting $2,820, $3,000, or even $3,200. A robust bullish trend will only materialize above $3,400.

Conversely, immediate support is around $2,500. A fall below this threshold will confirm continued bearish momentum, potentially leading to price drops to $2,100, $2,000, $1,800, or $1,500. A breach below $1,500 could see Ethereum plummet to $1,000.

Traders may consider buying on dips near $2,500, with a stop loss set around $2,300 and a target price of $2,820.