Barclays notes:

The euro area economy is still on track for a modest recovery in 2015; we expect GDP to grow by 1.4% this year and 1.6% next year, ie, slightly above trend.

We do not expect economic activity to accelerate further. Business surveys have been levelling off since the beginning of the year, with PMI indices stabilising around the pre-crisis historical average of 53-54. Growth generally remains constrained by the high level of debt in both the public and private sectors, while adverse demographic trends and structural impediments, such as labour market rigidity and a lack of competition in non-traded goods sectors, remain a major hurdle to further acceleration in activity.

According to our calculations, world demand to the euro area (trade-weighted imports from euro area trading partners) grew by a meagre 0.3% q/q, while euro area exports were up 0.6% q/q. Monthly trade data available up to May showed some improvement, consistent with our forecast that export growth should at least double between Q1 and Q2. Exports to the US and Japan have remained on a strong footing, while the decline in exports to OPEC, Russia and to a lesser extent China has moderated.

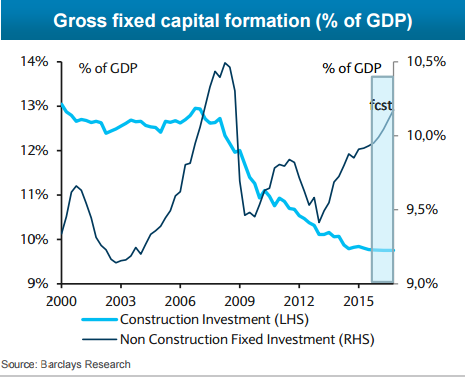

In Q1, both investment and public consumption surprised to the upside. Gross fixed investment grew by 0.8% q/q, its strongest pace since Q1 11, as both construction and productive investment were up. Although it may be premature to draw strong conclusions from that rebound, this could be related to the better growth outlook and to very easy financial conditions, which may eventually translate into some willingness to expand production capacity.

Meanwhile, government consumption jumped during the first three months of the year (+0.6% q/q), a growth rate not seen since 2009 when fiscal policy was still expansionary. In our view, this reflects an easing in the fiscal stance in some member states that we expected three months ago.

Euro area GDP to grow slightly above trend

Monday, July 27, 2015 10:20 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022