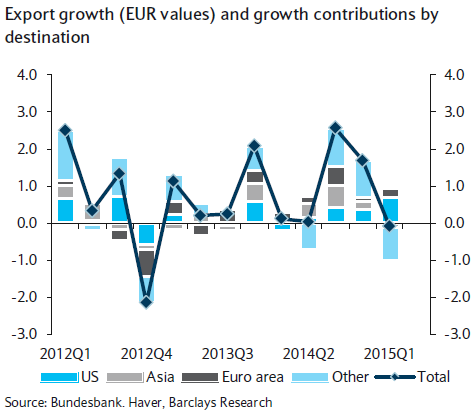

Euro area export growth slowed further in Q1 (0.8% q/q after 1.0% in Q4) reflecting a slump in shipments to several major emerging markets and OPEC countries. Notably, exports to China declined significantly (-4% q/q) after having risen continuously since mid-2012. The biggest decline in export volumes in relative terms, however, continues to be recorded for shipments to Russia, which have fallen by more than 30% so far in 2015 (January-April, y/y). Because of Russia's recession and EU sanctions, lower exports to Russia is likely to subtracted about 0.25% from 2015 GDP growth in Germany, says Barclays.

The US is set to become the most important export destination for German firms this year as export volumes to the US are on track to exceed those to France (Germany's main trading partner for many decades). Exports to other euro area countries are recovering gradually, but their relative share, at about 35%, remains far below the early-2000 level (about 45%). The latest trade and factory order figures indicate a rebound of export growth in Q2 and a robust performance in H2 is expected on the back of better demand from Asia and other parts of the euro area, where gradual recovery of investment demand seems to be under way, estimates Barclays.

Euro area export growth likely to robust in H2

Thursday, July 23, 2015 7:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed