Most of the long-duration-biased EUR rates trades have done well lately. While risks are seen towards further bullish moves, risk/reward is no longer as compelling after reaching the profit-taking targets and considering that illiquidity in August can complicate market moves.

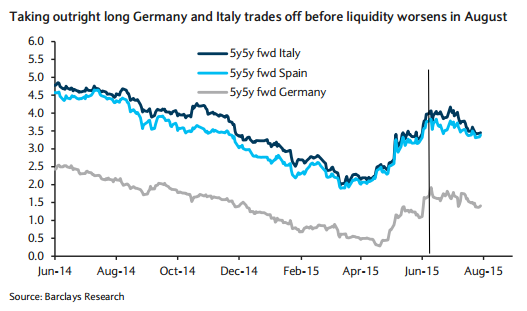

"We recommend closing long outright 10y Bund and 5y5y fwd Italy trades, as well as long the Bund ASW versus EONIA trade," notes Barclays.

The lack of summer activity has started affect the rates market gradually. The FOMC meeting was the most important event of the week. However, with the Fed leaving all options on the table for September meeting, there was no striking market movement triggered either. Overall, 10y Bund yields rallied another 4bp to 62bp (DBR 0.5% Feb 2025), and 10y Treasuries sold off c.5bp on the week.

On the data front, the IFO business confidence index in Germany came in better than expectations in Europe. Euro area July flash HICP will be released on 31 July; 0.1pp lower than consensus is expected in both headline and core (Barclays headline/core 0.1%/0.7%; consensus headline/core 0.2%/0.8%). The recovery in euro area inflation will likely be much slower than ECB projections indicate for 2016 and 2017. Indeed, as part of its latest Economic Bulletin, the ECB released a box article titled "Has underlying inflation reached a turning point?", which acknowledges the pick-up in headline and core inflation since February. However, it concludes that it is too early to interpret this as euro area inflation having turned the corner from a statistical point of view. This conclusion, if anything, reinforces the argument that the ECB is likely to be fully committed to completing its QE programme and will stay ready to do more if necessary.

Euro area rates: Weekly review

Thursday, July 30, 2015 11:53 PM UTC

Editor's Picks

- Market Data

Most Popular