Since the great recession of 2008 & aftermath of Euro zone debt crisis in 2011,

- Euro economies are going through the phase of belt tightening.

- Some economies like Ireland, Portugal, Spain & Greece are going through tough measures of austerity.

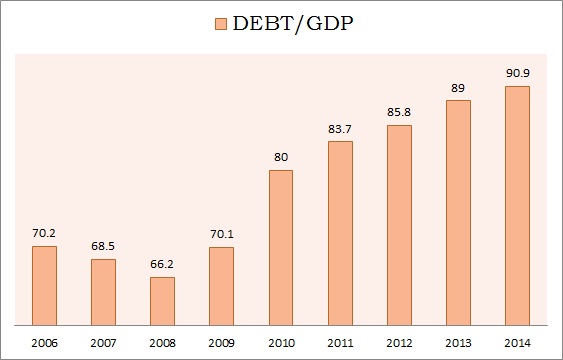

The purpose of the measures is to reduce the deficit in the Euro area economies to more sustainable level and also to reduce the debt burden through the reduction of DEBT/GDP ratio.

Despite the efforts, our research shows that the euro area is not actually deleveraging. Instead the debt to GDP ratio has gone up from 66.2% of the GDP in 2008 to 83.7% in 2011. Even in the aftermath of the debt crisis the ratio has increased to 91% of the GDP.

We believe that this data has increased for two major reasons-

- Economies are leveraging as a whole which is not bad necessarily if increased in a sustained pace and the ability to pay back remains, this is positive for the Euro or the Euro area indices & so far has muted impact. Euro currently trading at 1.138 & DAX at 10,900 levels.

- The growth has severely faltered in the euro area, which has so far in six years, not reached the pre-crisis level. This has not gone well for the Euro & Euro area bond market.

The chart is the graphical representation of Euro area DEBT/GDP ratio over 8 years.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings