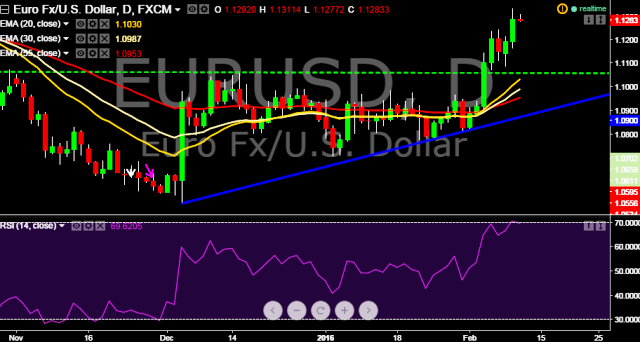

Pair is currently trading around $1.1282 levels. It made intraday high at $1.1311 and low at $1.1277 levels.

- The euro currency significantly rose against the greenback on Tuesday, spiking to the lowest point since October 2015.

- Intraday bias in EUR/USD remains on the upside.

- A daily close above $1.1351 levels will take the parity at $1.1686 marks.

- On the downside, break of 1.1050 support levels will be first sign of reversal and turn focus to 1.0809 support levels.

We prefer to take long position is EUR/USD around $1.1260, stop loss $1.1050 and target $1.1495 levels.