One of the principal causes of the recent USD's weakness against Euro is probably the weak risk appetite. Of-late European equity segment has been maintaining a very cautious approach with the currency exposure (EURUSD) as more hedging activity seen in this region also which is in light of European Central Bank's latest easing programme.

A day like today sees both sides of that trade going very wrong, thus perhaps a major contributor to this pair fails to sell off despite yesterday's quite strong US ISM non-manufacturing survey release that saw a reasonable pickup in Fed hike expectations out the curve to the highest level in over a month.

We sense an early signs of recovery in EURUSD evidencing an attempt of a fairly strong bullish candle in intraday charts in response to weaker US ADP data. With the first minor resistance breached around at 1.1226 ahead of the major 1.1290 top, while the clear support area is the 1.1129 level to the downside.

Derivatives insights:

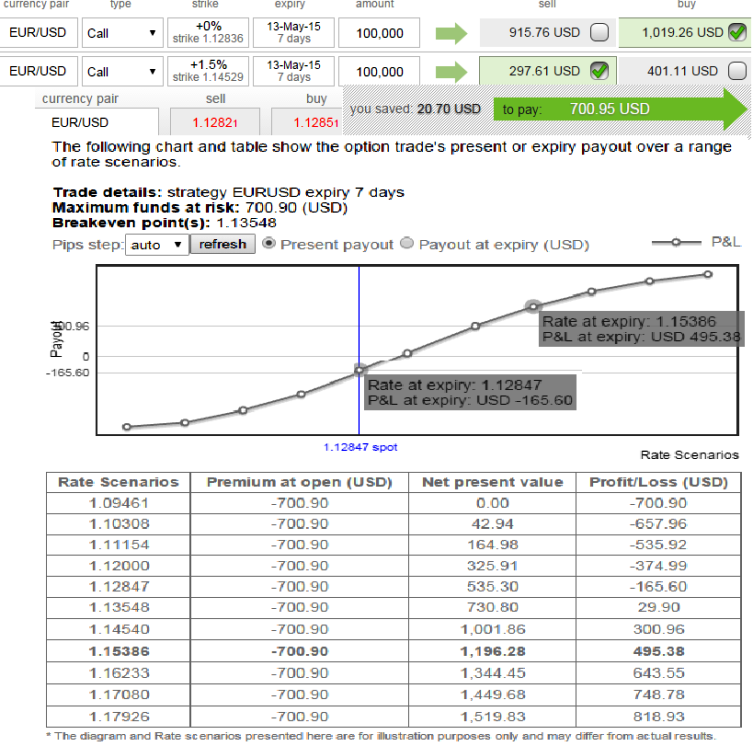

Option basket: Bull call spread

In order to establish this strategy, it is recommended that the buying a call and sell another call with a higher strike price with the same expiration date for a net premium payable. Employ a Bull Call Spread over a long call when the cost of the long call is too expensive and the underlying currency is expected to move fairly higher.

The chart explains the different credits effected at different exchange rates. Credit from short call reduces the cost of long call.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?