European Central Bank's policy easing had already boosted investor and consumer confidence over the region's future, now hard economic dockets continue to provide evidence of acceleration.

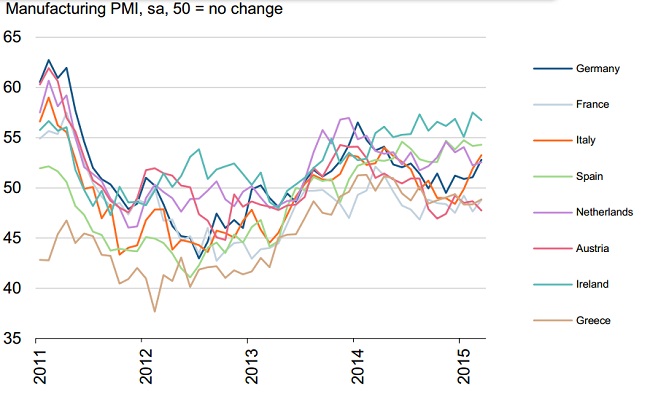

- Spanish manufacturing PMI rose to 54.3 from prior 54.2.

- PMI for Italy rose to 53.3 compared to prior 51.9.

- Netherland PMI rose to 2 month high at 52.5.

- Spanish PMI improved but still growth in negative trajectory. PMI came at 48.8, above 50 indicates growth.

- German PMI rose to 52.8 from 51.1 prior.

- PMI improved even for Greece at 48.9, still negative.

- Overall Euro zone PMI jumped to 52.2 from prior 51.

- Ireland PMI recorded 56.8

- PMI for Austria reached four month low at 47.7

Key highlights -

- Growth in manufacturing production has hit ten-month high.

- Ireland and Spain recorded steepest gain in new export business and orders, providing signs that after years of austerity these two following country might actually stand on their own and compete with the core countries like Germany.

- Increased export orders were registered in Germany, Italy, Spain, Netherlands and Ireland, thus indicating that weaker Euro might not benefit Euro zone as a whole, some might incur higher import cost.

- Euro zone as a whole first time 11 months recorded accumulation of outstanding work. This will further boost employment in the region.

- Due to weaker Euro businesses are experiencing higher input cost that might lead to higher cost of products and services across region. However such inflation would be temporary and transitory.

European Central Bank's asset purchase program is strengthening economic recovery which would be very beneficial for the zone in longer run.

European stocks remain good bets as companies will be the ones to benefit most out of the current policy easing.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings