Yesterday consumer price index (CPI) stat for June showed subdued inflation across Euro zone, with persistent deflation in weaker countries such as Greece, Cyprus, Slovenia and Lithuania.

However inflation expectations both in the short run and longer run has risen for second consecutive quarter and that is quite rapidly as European Central Bank (ECB) introduced asset purchase program of € 60 billion per month.

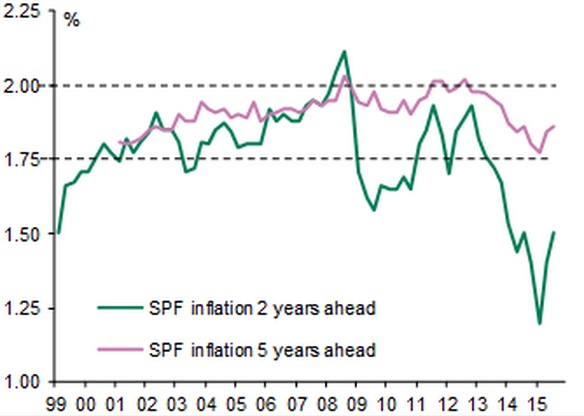

- According to ECB's survey of professional forecasters (SPF) report inflation may remain subdued this year but will gradually gather pace in next and beyond.

- As per the survey, Euro zone inflation is likely to be 0.2% in 2015, 1.3% in 2016, and 1.6% in 2017.

- Longer run inflation expectation, which measures over 5 year is expected to be at 1.9% by 2020.

It is welcoming news and evidence that inflation expectations are rising, however that is unlikely to be a threat to European Central Bank's (ECB) asset purchase program.

With monetary policy divergence at focus, Euro is likely to remain depressed against Dollar and Pound. Euro is currently trading at 1.088 against dollar and 0.696 against pound.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate