After months of lagging behind their conventional peers, inflation linked bonds are back in heavy demand. European Central Bank's (ECB) monetary policy seems to be working in the right direction.

- Germany sold record 10 year inflation linked bonds at record yield of -1.09% this week, compared to last month's -0.86%.

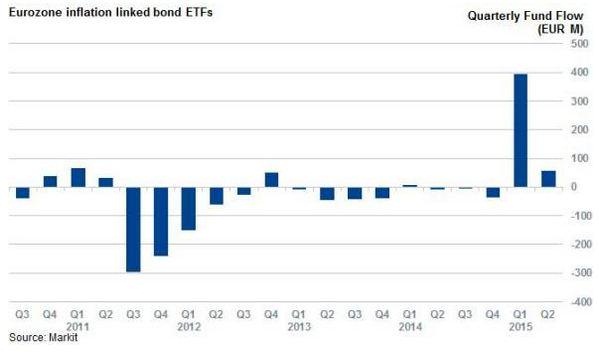

Chart from Markit shows investors have poured in record money to European inflation linked bond ETFs in the first quarter of 2015. Second quarter is expect to remain robust. First quarter saw fund flow of record € 400 million in this segment. This is the largest inflow on record.

ECB's asset purchase program gave rise to inflation expectation and surge in break-even inflation. That lead to outperformance by inflation linked bonds compared to their conventional peers.

- Break even inflation for 5 years as measured from 5 year inflation linked bunds is hovering close to 1.2%, up from 0.2% in January 2015.

Inflation indexed bonds are expected to outperform their peers over coming quarters and Euro to trade with downside pressure from falling yield difference against dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings