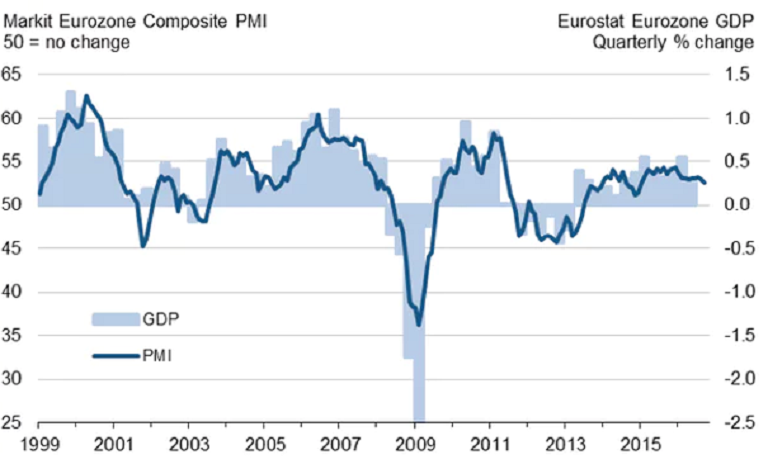

Eurozone’s services, manufacturing and businesses remained muted during the month of September, as is reflected by the composite measure of the Purchasing Managers’ Index (PMI) that declined to its lowest level in almost 20 months.

The Markit flash Eurozone PMI composite index declined to 52.6 during the month of September from 52.9 in the previous month. The manufacturing index strengthened to 52.6 from 51.7 previously and was above the consensus forecast of 51.5.

In contrast, there was a decline in the services-sector reading to a 21-month low of 52.1 from 52.8 and was below expectations of an unchanged reading. In the manufacturing sector, orders strengthened to a three-month high with export orders registering the highest reading for 30 months.

Further, services-sector order books rose at a weak pace and optimism surrounding the level of activity over the next 12 months declined to a 21-month low. There was a small growth in employment, although job creation outside German and France declined to the lowest level for 15 months.

Moreover, average input costs rose for the sixth month running, at a pace faster than in August and there was a marginal increase in output prices for the first time in 13 months. However, the French composite PMI was higher than the German figure for the first time in four years.

"Slower growth in the German power house and elsewhere in the currency union suggest the upturn will remain uneven by country heading into the final quarter," said Rob Dobson, Senior Economist, IHS Markit.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength