FOMC after long months of hawkish bias sounded pretty much dovish in last night's statements. Participants reduced their projections for economic activity years ahead.

Expectation difference

- In December 2014, FOMC participants were expecting a rate hike of 1.50% by end of 2015. Market was expecting at most one or two hikes in 2015.

- January saw a general reduction in FED funds rate expectation by participants, with average median reached 1.125% by end of 2015. Market still unmoved, was predicting first hike around September/October 2015.

- Last night median forecast of FED funds rate dropped dramatically to 0.625, which is a 50 basis point reduction within just 2 months.

Questions -

Last night's FOMC statement and projection make room for several questions.

- FED participants reduced growth projection by 0.3%. Max range for inflation saw cut by 0.8%. FED funds expectation saw cut down by 50 basis points. So the real question is if the weakness in the economy is going to persist. If so, FED hike could be delayed.

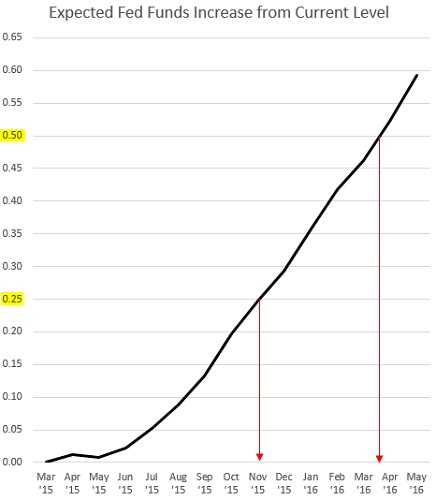

- So far, market seems to be right about the interest rate expectation as participants reduced and market remained stable. On that line current expectation of a first rate hike is pushed to November 2015 and second hike to 0.50% to April 2016.

Dollar has gained back almost all the ground in today's trading as alternative for yields remain limited. Dollar index is trading at 98.7, up 1.1% for the day.

However, if economic dockets weaken and FED does not provide June hike, dollar might suffer big time.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand