Reserve Bank of Australia (RBA) has held policy rates steady since May and as of latest indication, policy is likely to remain steady in the near term.

Australian Dollar has also stabilized in the near term as Reserve Bank of Australia (RBA) changed its tone and guidance towards Aussie. Weaker Aussie attracted inflows, especially from China to its housing sector, leading to massive price rise, especially in Sydney and Melbourne. In recent days, it might also be leading to worsening of Australia's terms of trade as weaker Aussie makes the imports more costly.

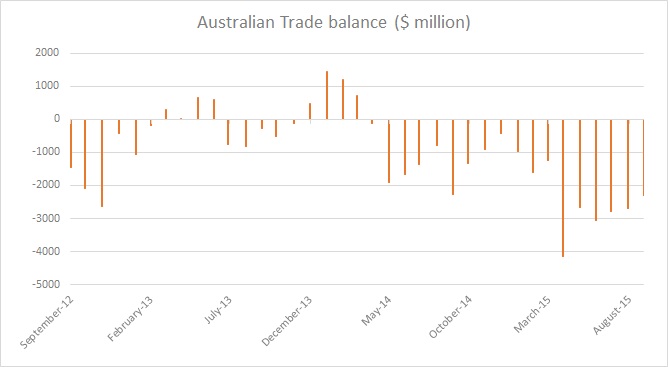

However, looking at Australia's trade balance and state of the miners, it would not be unfair to say, further weakness in Aussie would be beneficial.

- Latest report shows, marginal improvement in the trade balance but overall in in deep negative territory. Trade balance for September came at -$2.31 billion. Last time, Australian trade balance came positive was back in April last year. Since then commodity rout worsened outlook for Australian miners.

With slowdown in China, outlook for Australian exporters, especially of bulk commodities such as coal, iron ore look bleak.

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K