In spite of all the forward guidance and communications from FED officials, survey shows there exists considerable uncertainty over today's rate decision.

Economists surveyed by Bloomberg shows that they are almost evenly distributed over today's decision.

FED's willingness to hike rates in 2015, indicated that FED is willing to pull the trigger even before inflation reaches target.

Key highlights -

- Considerable uncertainty regarding rate hike might have created financial market turmoil and traders are remaining ever cautious over the incident. Argument is that if FED willing to pull trigger before inflation reaches 2% objective it might as well do it now and kill the uncertainty.

- Many central bankers, in emerging markets such as Governor of Indonesian Central Bank, have called in FED to hike rates in September as it would kill the uncertainty around it and might ease financial conditions.

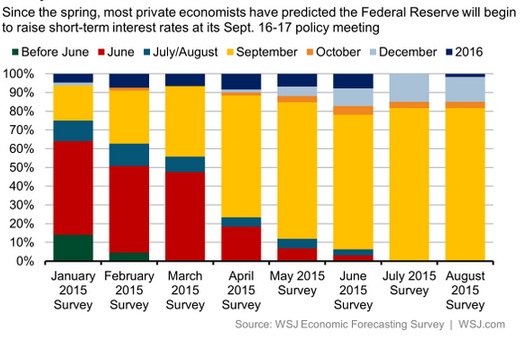

- As the chart shows, in 2015, market was expecting a hike as early as March, which was pushed back due to stronger Dollar. Expectations then shifted to June, which was again pushed back by weaker economy in first quarter. Focus now is on September, though expectation has shifted to December.

FOMC will announce monetary polcy decision at 18:00 GMT, followed by press conference at 18:30 GMT by Janet Yellen.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate